Image by: kentoh, ©2017 Getty Images

What’s New with the ECD Acquisition?

Post-acquisition, OpenText is already enjoying the fruits of the deal. In October, they unseated IBM as the new market leader in Gartner’s revamped Magic Quadrant for Content Services, thanks in large part to the addition of ECD and their increasingly dominant marketshare. Just a month later, OpenText slightly beat analyst predictions for its first quarter earnings of fiscal 2018, reporting $36.69 million on revenue of $640.7 million. This was roughly a 30% increase from the same time last year, undoubtedly helped by the integrated products of ECD. In that same quarter, OpenText continued its buying spree, acquiring Covisint, a cloud-based identity management and Internet of things (IoT) platform, and forensic security company Guidance Software. While OpenText reported organic top-line growth (they declined to disclose the number due to policy), OpenText CEO Mark Barrenechea expects to see low, single-digit organic growth. For now, it seems that OpenText will continue to chase acquisitions as the quick and efficient path to its revenue growth.As for ECD, Mr. Barrenechea in last month’s earnings call reported that they nearly doubled ECD's adjusted margin performance, from 13% to 25%. Integration efforts are on pace and set to conclude in January 2018 in which OpenText’s focus will swing to ECD's performance. We look to the new year for more clarification by OpenText on how they intend to grow this portfolio, as some analysts predict a sharp decline in revenue from this acquisition in quarter three. At this point, it looks like OpenText is getting exactly what it wanted from ECD.

Meanwhile, there continues to be turbulence within the ECM space, as anxiety and concern over the future of Documentum persists—not to mention the seismic shift from ECM to content services. The dream of the single, centralized ECM solution is fast-disappearing from the rear-view mirror, since it never really materialized like so many had promised. Instead, IDC Research Vice President Holly Muscolino says there is growing acceptance that the emergence of “new architectures, which will be repository-neutral, metadata-focused, and API-driven, will enable us to create purpose-built solutions that solve different problems but are based on a common technology stack.”

This is a bitter pill to swallow for many who have invested years and years into their large, on-premises solutions. While many analysts predict that this migration will be slow, it is happening, creating uncertainty for many enterprises on how to make this move and when to do it. Recent accusations lobbed at those individuals reflecting these enterprise anxieties, such as intentionally trying to profit from the disruption, deliberately propagating fear, uncertainty, and doubt (FUD), or labeling individuals as rogue agents who are not to be trusted, are a disservice to the intelligence of the industry as a whole—and, most of all, to information management leaders who have invested enormous capital, time, and resources to these systems. Like many other technology segments, the ECM landscape is being recast, calling for enterprise leaders to be much smarter in their decision-making than the last time.

At the time, OpenText introduced the concept of “extended ECM,” leveraging services to “extend the value of existing investments in hybrid scenarios” by building applications and integrations, enhancing content with structured data, and bridging silos with other information resources, whether in the cloud or on-premises. According to Ms. Hobert, Leap is a “cloud-based, microservices architecture for ad hoc, content-related activities in the cloud and is a strategy that OpenText is building around platforming and microservices-oriented architecture.” This idea of extending ECM is carried over to OpenText’s Release 16.4, expected in the Spring, with “data visualization, analytics, and reporting [capabilities]. Documentum 16.4 will also include a recommendation engine that correlates analytics with content for a better search experience,” reports Stephen Ludlow, Senior Director of Enterprise Product Marketing at OpenText. Some of this extensibility could be perceived as an avenue to support their cross-pollination efforts as well.

It is clear that OpenText is committing to content services, but it’s unclear how they plan to build a business case around it, how they will distribute this new architecture, or how they plan to earn revenue from this realignment. For enterprises, transitioning from on-premises solutions to the cloud is a complex process and fraught with challenges. We expect to hear from OpenText in 2018 on their execution strategy.

Are We Storing Content, or Are We Using Content?

It is not an exaggeration to say that we are in the midst of content management chaos. Cloud, consumer-based collaboration, and mobile technologies have only multiplied the amount of digital, unstructured content that flows inside an organization—at such a rate in which humans simply can’t sustain it. The definition of digital transformation is about more than simply digitizing our content but is really about how we use it across numerous use cases, according to Gartner Research Director Karen Hobert. “The classic scenario around ECM was always focused on the command and control of the content [i.e., records management, life cycle management, audibility, etc.], not necessarily the pure usage of it.” With this lens (using content for purpose), strategies around content services are becoming much more important for organizations. Information leaders out there have an understanding that critical knowledge is locked up inside these siloed repositories. As traditional ECM solutions evolve into platforms of services, applications, and components, the idea of where content is stored will not be as important as how we access and use this content. “The first step in platforming allows for the ability to deliver that pervasive and comprehensive access (and critical oversight/governance) across all unstructured content, regardless where it is,” explains Ms. Hobert.

According to Gartner, the evolution of content services is about addressing the needs across all organizational systems, including systems of record (structured, auditable, managed content), systems of differentiation (processing of content to address a particular business problem), and systems of engagement (leveraging unstructured content through ad hoc, collaborative instances).

A Snapshot of the Content Services Market

Gartner reports that the content services market is worth six billion dollars, with eight percent growth from 2015 to 2016. While projected growth might be behind faster moving segments, there remains a fertile marketplace for content services. There is continued consolidation in the vendor landscape (e.g., ECD’s arrival at OpenText, Hyland’s acquisition of the Perceptive Software business, and Hewlett Packard Enterprise merging with British company Micro Focus, along with divesting their iManage business). This consolidation means that the three leaders in Gartner’s Magic Quadrant will have a larger share of the market, but the "Others" category, made up of over 1,000 vendors worldwide, controls the biggest segment at 29% of the market. The bottom line is that enterprise buyers will be able to select a vendor based on their enterprise or industry-focused needs rather than because of a shrinking landscape.A Second Look at OpenText’s Integration Strategy

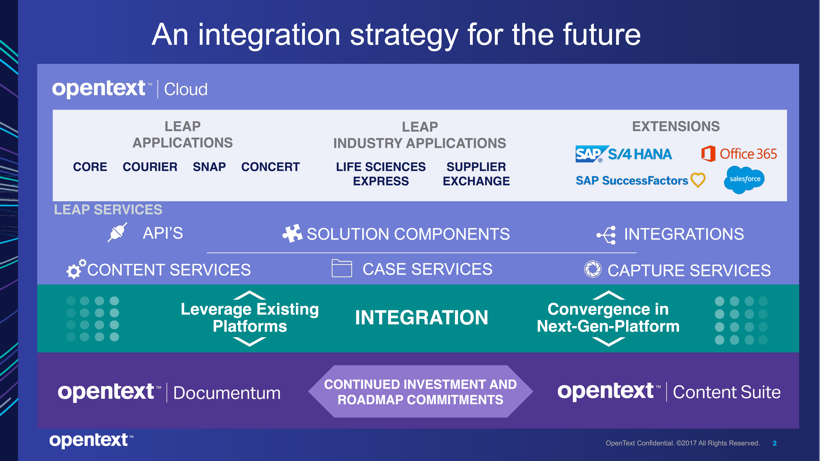

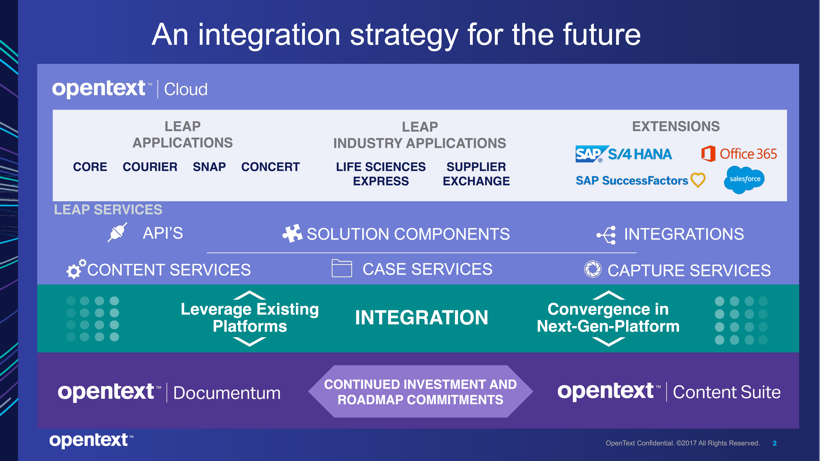

In a statement to DOCUMENT Strategy, OpenText was pretty empathic about the future of the industry—and their own. They stated, “The future of ECM is in the cloud, and our strategy is to support our customers with a roadmap that allows them to leverage existing investments made in on-premises applications as they move toward their cloud future.” In July at their annual user conference, OpenText presented their integration strategy for ECD, along with Documentum, and their new, re-architected vision for content services. For the past six months, there has been little change in their communications surrounding this strategy.

At the time, OpenText introduced the concept of “extended ECM,” leveraging services to “extend the value of existing investments in hybrid scenarios” by building applications and integrations, enhancing content with structured data, and bridging silos with other information resources, whether in the cloud or on-premises. According to Ms. Hobert, Leap is a “cloud-based, microservices architecture for ad hoc, content-related activities in the cloud and is a strategy that OpenText is building around platforming and microservices-oriented architecture.” This idea of extending ECM is carried over to OpenText’s Release 16.4, expected in the Spring, with “data visualization, analytics, and reporting [capabilities]. Documentum 16.4 will also include a recommendation engine that correlates analytics with content for a better search experience,” reports Stephen Ludlow, Senior Director of Enterprise Product Marketing at OpenText. Some of this extensibility could be perceived as an avenue to support their cross-pollination efforts as well.

It is clear that OpenText is committing to content services, but it’s unclear how they plan to build a business case around it, how they will distribute this new architecture, or how they plan to earn revenue from this realignment. For enterprises, transitioning from on-premises solutions to the cloud is a complex process and fraught with challenges. We expect to hear from OpenText in 2018 on their execution strategy.

Furthermore, OpenText now holds two potentially viable solutions—Documentum and Content Suite—that could be further developed with content services. Gartner classifies Documentum as a classic content management system (i.e., traditionally focused on command and control, with records management, and a strong tie into InfoArchive), but with extensibility. On the other hand, Content Suite is being positioned as the “broader content services backbone.” Ultimately, both are extensible to each other as well—through APIs and applications. This presents a very murky picture for customers looking to migrate to these new architectures, as well as how OpenText will position future “enhancements” via their new artificial intelligence (AI) platform Magellan. When we asked Ms. Hobert at Gartner what customers could possibly anticipate, she told us, “If I had a crystal ball, I would suspect, over time, that they would converge into a comprehensive suite, so to speak. Moving forward, I would expect that they would put their development focus and value proposition on one product.”

Since OpenText is an acquisitive company, it is sometimes hard to know what to pay attention to at any given time. With investments in a broad range of areas, such as security, analytics, IoT, AI, customer experience, content services, and customer communications, it is challenging to pinpoint a holistic narrative on how OpenText is stitching all these elements together, other than to say that they “optimize how companies acquire, analyze, interact with their data and then transform that data into knowledge and information to drive their enterprise forward.”

The reality is that digital transformation has set off a deep fissure within this industry, splitting those that cling to the old ECM dream and those that are marching toward the new ECM future. Last month, we already weighed in on the problems facing classic content management systems in this new era. These are systematic, unavoidable changes across the industry as a whole, but big acquisitions often invite a glaring spotlight revealing the turbulence and anxiety within. “The overall trend across the industry as a whole is that customers are moving away, maybe not quickly, from legacy, on-premises, monolithic solutions. So, I think we will see people move away from Documentum, as well as Content Suite, Oracle WebCenter, and IBM FileNet and move to cloud-enabled, API-first solutions.” Ms. Muscolino predicts.

Most can agree that this migration will not be a “rip and replace,” a financial improbability. However, we expect there to be continued disruption and turbulence as both enterprises and technology vendors grapple with these emerging requirements. So, what should enterprise leaders do with this information? With an eyebrow-raising 82% of surveyed Documentum users reporting that they use basic content repository capabilities, followed by workflow (55%) and records management (48%), I pose this question: Are you looking to store content, or are you looking to use your content for purpose? The answer to this question will ultimately serve what technologies you choose to support it.

Since OpenText is an acquisitive company, it is sometimes hard to know what to pay attention to at any given time. With investments in a broad range of areas, such as security, analytics, IoT, AI, customer experience, content services, and customer communications, it is challenging to pinpoint a holistic narrative on how OpenText is stitching all these elements together, other than to say that they “optimize how companies acquire, analyze, interact with their data and then transform that data into knowledge and information to drive their enterprise forward.”

Our View

It seems we are in a holding pattern for now, and not surprisingly, nearly 72% of the 220 Documentum users surveyed by ECM firm Doculabs reported they were either planning on maintaining or undecided about their five-year plans with Documentum. A little less than 23% indicated they would sunset the technology, and the smallest segment reported plans on investing in the system.The reality is that digital transformation has set off a deep fissure within this industry, splitting those that cling to the old ECM dream and those that are marching toward the new ECM future. Last month, we already weighed in on the problems facing classic content management systems in this new era. These are systematic, unavoidable changes across the industry as a whole, but big acquisitions often invite a glaring spotlight revealing the turbulence and anxiety within. “The overall trend across the industry as a whole is that customers are moving away, maybe not quickly, from legacy, on-premises, monolithic solutions. So, I think we will see people move away from Documentum, as well as Content Suite, Oracle WebCenter, and IBM FileNet and move to cloud-enabled, API-first solutions.” Ms. Muscolino predicts.

Most can agree that this migration will not be a “rip and replace,” a financial improbability. However, we expect there to be continued disruption and turbulence as both enterprises and technology vendors grapple with these emerging requirements. So, what should enterprise leaders do with this information? With an eyebrow-raising 82% of surveyed Documentum users reporting that they use basic content repository capabilities, followed by workflow (55%) and records management (48%), I pose this question: Are you looking to store content, or are you looking to use your content for purpose? The answer to this question will ultimately serve what technologies you choose to support it.

Allison Lloyd serves as the Editor of DOCUMENT Strategy Media. She delivers thought leadership on strategic and plan-based solutions for managing the entire document, communication, and information process. Follow her on Twitter @AllisonYLloyd.