This article appears in the Summer 2017 digital issue of DOCUMENT Strategy. Subscribe.

Image by: Nastasic, ©2017 Getty Images

Every year, hundreds of customer communications and information management leaders gather at DOCUMENT Strategy Forum (DSF) to discuss the state of their document strategies. Due to complexity, organizational siloes, unclear vision, or lack of governance, justifying (or, if you’ve overcome the cost hurdle, sustaining) an enterprise-wide document strategy is a significant challenge. This industry lacks considerable resources in this area, which is why we brought together some of the leading practitioners in this space to create the first peer-produced framework for executing the document strategy.

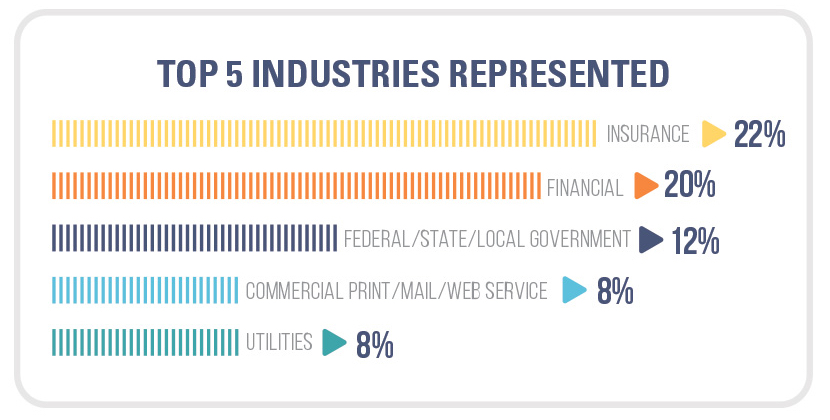

Now, we take the next step in measuring our success and assessing the maturity of these ongoing programs at organizations today. Participants in this survey consist of 136 practitioners in attendance at DSF ’17, all of whom command a document management program producing at least 499 million to over three billion documents (paper and electronic) monthly.

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

As consumer expectations become more mature, the insurance and financial services industries are increasingly focused on adopting omni-channel experiences, a single customer view, integrated data, and personalization. As a result, we see both sectors making up just below half of the businesses represented at DSF ’17. Of note, the utilities sector doubled from 2016, reflecting this vertical’s need to foster improved customer engagement and satisfaction—which continues to lag behind insurance and financial services.

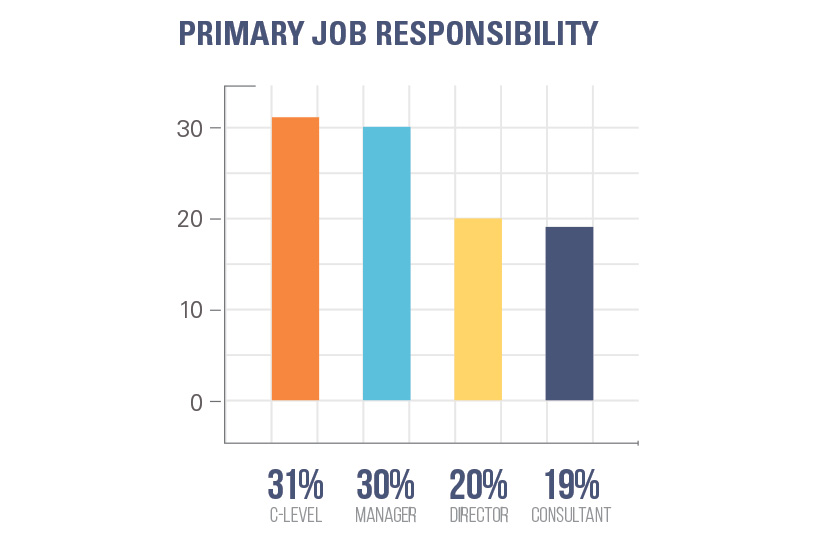

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

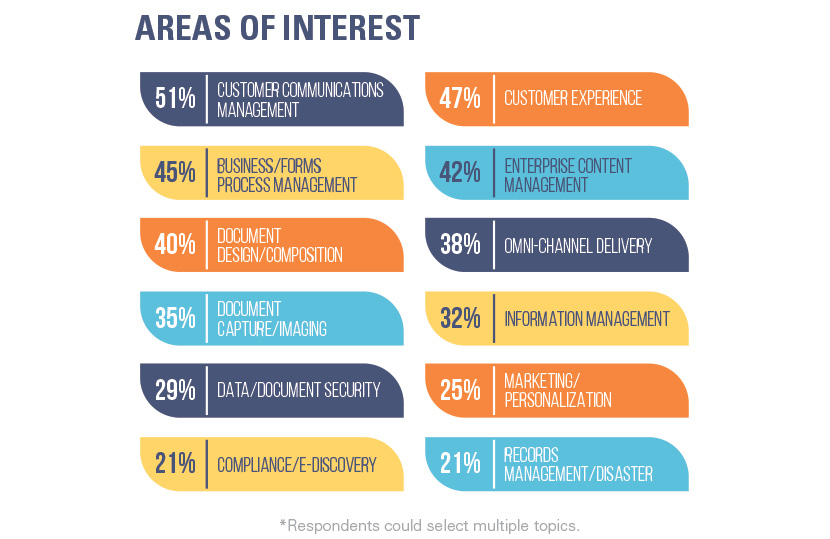

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

Creating superior customer experiences requires coordinated content, data, and systems. Through this lens, customer-centric approaches are challenging long-held document and information siloes. In fact, when participants were asked to select primary areas of interest, the results were dispersed over a myriad of topics, with the top 10 areas pulling in at least a fourth of the total surveyed. Furthermore, the areas of compliance/e-discovery and records management/disaster recovery was close behind, receiving almost a fourth of the total. This is even more significant as respondents could select multiple areas. What’s the bottom line? Customer experience strategies are forcing organizations to recognize the many moving parts of the customer journey, and inevitably, this means understanding all these areas and inherent connections.

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

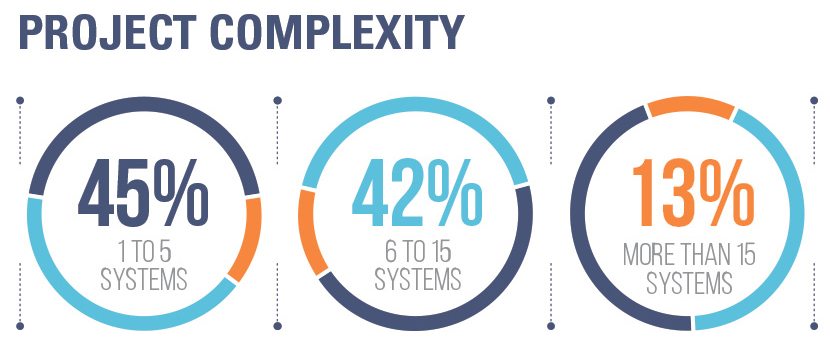

To determine typical project complexity at organizations represented, we asked participants to identify the number of systems impacted by said project. The results show a split in complexity between a small number of systems impacted and a moderate amount.

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

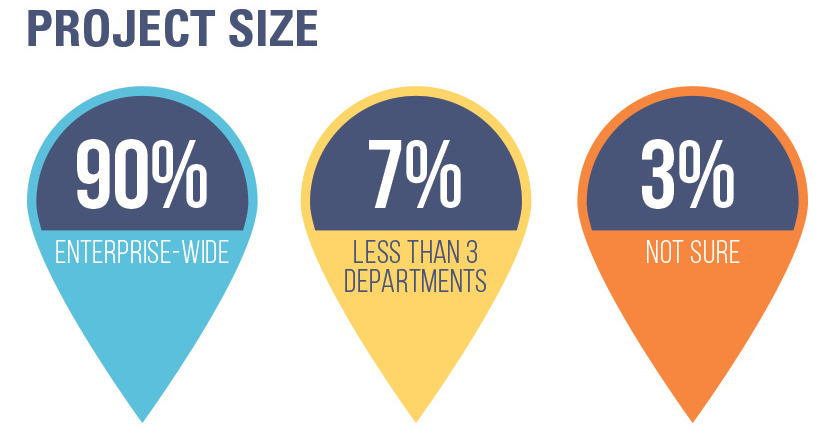

A key differentiator in assessing the maturity of strategic initiatives is whether they encompass multiple functions across the enterprise. We define an enterprise-wide project as one that involves at least three or more departments. A clear majority of participants report that their projects are enterprise-wide. This maps to our assumption that most participants represented in our survey manage complex and established document strategies.

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

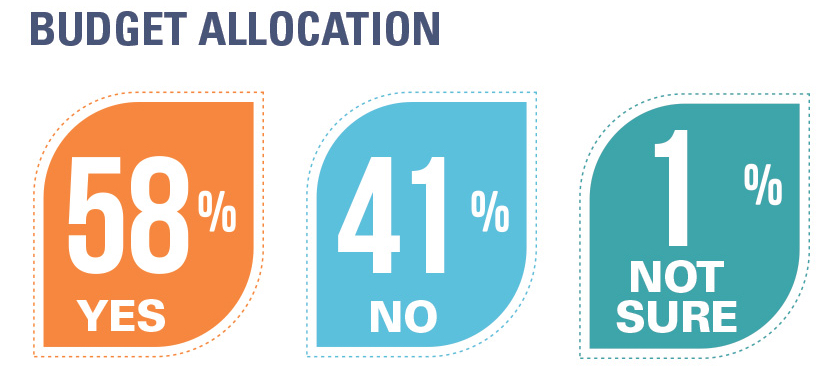

A true marker for the maturity of the strategy is consistent, dedicated budget allocated to the enterprise document/e-document strategy. Executive management teams who set aside money for these strategies display true commitment to the goals set forth. It is indeed a promising metric that the scale is tipped toward those organizations that cite established budgets for their document strategy. We here at DOCUMENT Strategy maintain that this monetary commitment should be at least for three to five years. However, for approximately 41% with no established budget, this mandate seems improbable. Due to this, we did not use time duration of allocated budget as a subset of measurement.

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

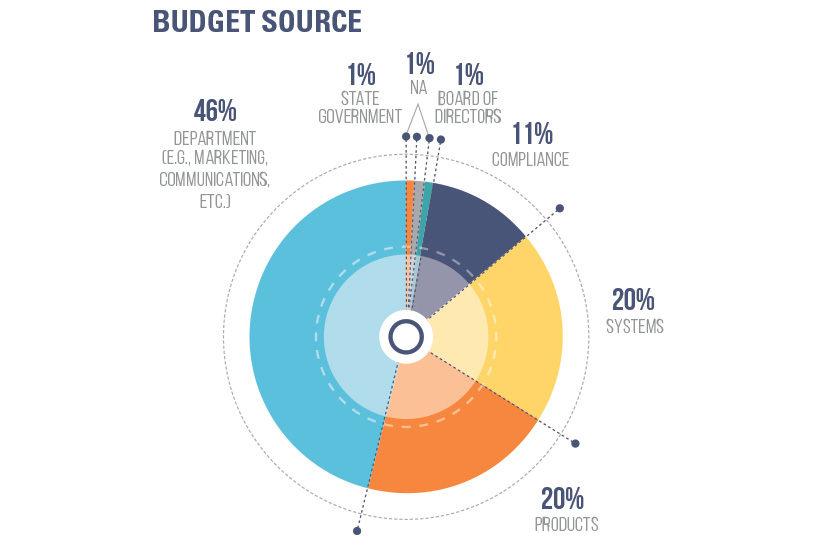

For those organizations citing no dedicated budget allocated to the strategy, we asked where they receive money for their projects. Not surprisingly, the largest source comes from departmental budgets, followed equally by products and systems.

Perhaps, the most important metric of all is who leads the document strategy. After all, getting buy-in and a powerful advocate is what can separate failure from success. Again, the results were dispersed among participants in identifying the leader of the strategy in the company.

Source: DSF Benchmarking Survey. Unauthorized reproduction prohibited.

Perhaps, the most important metric of all is who leads the document strategy. After all, getting buy-in and a powerful advocate is what can separate failure from success. Again, the results were dispersed among participants in identifying the leader of the strategy in the company.

First, the good news: Participants cited the most common leader of the strategy is the executive management team. This is of particular note, as many organizations have struggled in the past to convince the C-suite of the value of the document strategy. The emergence of customer experience, privacy concerns, and information security might be helping the case for this particular team of leaders. Not surprisingly, the cross-functional team closely follows at approximately 22%—a solid approach to creating a unified strategy.

Now, the bad news: No formal leadership lands right in the middle, making us realize that there’s still a lot of work to do. Lastly, it appears as if we haven’t done enough to catch the attention of the Board of Directors. Some organizations will have to roll the document strategy within the priorities aimed at the Board-level.

It might be noticeable that the survey did not even skim the areas of people, process, technology, or governance functions of the document strategy. Our benchmarking survey will focus on these areas in the future, as we measure organizations’ maturity each year at DSF.

It might be noticeable that the survey did not even skim the areas of people, process, technology, or governance functions of the document strategy. Our benchmarking survey will focus on these areas in the future, as we measure organizations’ maturity each year at DSF.

Allison Lloyd serves as the Editor of DOCUMENT Strategy Media. She delivers thought leadership on strategic and plan-based solutions for managing the entire document, communication, and information process. Follow her on Twitter @AllisonYLloyd.