Image by: CSA-Printstock, ©2017 Getty Images

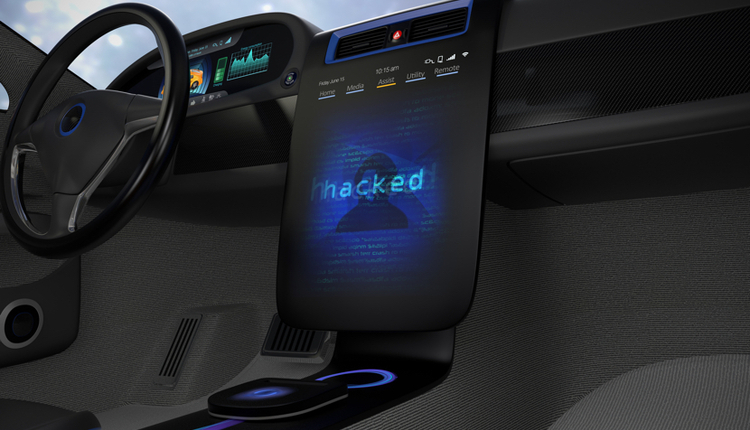

Fundamentally, blockchain will revolutionize trust, moving the needle away from fear, uncertainty, and doubt (FUD) and toward simpler, more trustworthy transactions. Assaults on our willingness to trust have exacerbated FUD—hackers, ransomware, big data consolidators like Google and Amazon, the government, and others who intrude on our privacy. Trusted sources, if not less trustworthy, seem so.

As the Russian proverb advises, "Doveryai, no proveryai (trust, but verify)," every transaction begins with an assumption of trust. Do we trust the vendor to ship goods? Do we trust the bank to transfer funds and have sufficient funds on hand? Do we trust the title company to conduct a thorough title search? Do we trust the Register of Deeds/Recorder to properly record the title? The answer can be based in tradition, historical experience, contractual compulsion, regulation and oversight, or a myriad of other trust disciplines. By and large, these intermediaries are trust brokers; intermediaries confirm the validity of, and execute, transactions—banks, stock exchanges, SWIFT, MasterCard, etc.—and, of course, they all take a haircut (fee) for this service.

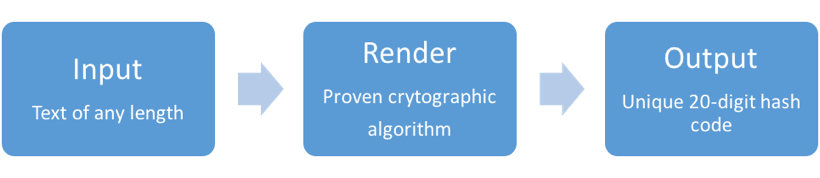

What blockchain offers is a new way to trust and verify without the need for intermediaries—or, in some cases, massively simplified intermediaries. Blockchain anchors its immutability on mathematical cryptography, which creates the unique hash key that is then used to authenticate transaction participants and activities. Here is the basic concept:

To have integrity, the blockchain participant needs a way to validate identity. In a private blockchain, there is a presumed expectation of trust because all members are invited participants, think supply chain. There are a lot of sources to determine trustworthiness—credit reporting agencies, the Better Business Bureau, bank references, other customer or vendor references, and, of course, when uncertainty exists, a bank letter of credit. But what if every participant had their identity and trustworthiness validated—they had a code that proved a transaction participant was capable of meeting their obligations? It would immediately simplify doing business and eliminate trust broker fees.

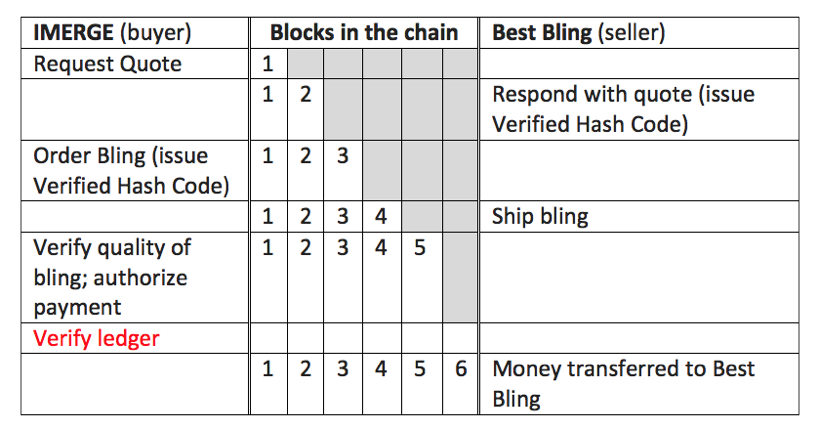

Let’s use a simple example: IMERGE is going to have a booth at the ARMA Conference. They decide to give away "bling" at the booth. They search and find some nice items online and prepare to order it. Both IMERGE and Best Bling, LLC have verified hash codes, validating that IMERGE has the money to pay and Best Bling has the ability to deliver. This simple transaction flow would be as follows:

Let’s use a simple example: IMERGE is going to have a booth at the ARMA Conference. They decide to give away "bling" at the booth. They search and find some nice items online and prepare to order it. Both IMERGE and Best Bling, LLC have verified hash codes, validating that IMERGE has the money to pay and Best Bling has the ability to deliver. This simple transaction flow would be as follows:

Each block in the chain contains all of the previous blocks, and each “row” has its own unique hash code, which is the combination of the previous and current blocks. This cryptographic approach means the blockchain is immutable. The ledger itself is distributed—both the buyer and seller have identical ledgers. In this example, the second to the last row shows the task of “verify ledger”—a check to be sure that the final hash codes match before authorizing payment. At the heart of blockchain is this concept of a distributed ledger where all nodes (participants) hold the ledger and validate the legitimacy of each transaction through cryptographic hash codes.

In reality, a simple transaction like this likely would not be improved using blockchain, but think about the last row—money transfer. Notice I didn’t use “bank” in that example. IMERGE and Best Bling could have digital wallets whose value is confirmed by the wallet’s blockchain (think Bitcoin or Ethereum) and the transfer would then be peer-to-peer or, in this case, wallet-to-wallet. Gee, we’re effectively back to a “cash economy” underwritten by blockchain digital currencies.

A typical supply chain would include international and national shipping companies, banks, insurance companies, railroads, bulk buyers, and more, making a blockchain far more complex. In this scenario, not all blocks would be included in all chains. For example, the railroad doesn’t care how a container arrives at its siding, only that it has arrived and is ready to be transported. Their blockchain would include the shipping order, estimated date of arrival at the siding, quantity, weight, etc. However, the ocean vessel data would be public, so the railroad could, if desired, track its position on the seas and know when it will be in port; or the shipping blockchain could issue a notification to the railroad when in port using the unloading schedule (yes, a blockchain can execute code; after all, the blockchain is stored in a database). Payment would be authorized and executed once the blockchain distributed ledger reaches agreement that contractual conditions have been fulfilled (known as a “smart contract”).

It is inevitable that supply chain automation will be one of the first applications of blockchain to eliminate time and cost associated with intermediaries, and no doubt, the industry will rapidly develop standards that further simplify and lower transactional costs of doing business.

Because blockchains are distributed, immutable ledgers, all parties can trust them. If any one ledger were modified/hacked, its hash code would fail to match the other ledgers; the hacked ledger would be repaired by agreement of the other ledgers (this is a gross oversimplification, but you get the idea).

Jim Just is a Partner with IMERGE Consulting, Inc., with over 20 years of experience in business process redesign, document management technologies, business process management, and records and information management. Contact him at james.just@imergeconsult.com or follow him on Twitter @jamesjust10.