Image by: wildpixel, ©2016 Getty Images

Xerox announced on January 29th intentions to separate into two independent operations, focusing on business process outsourcing and document technology. Closely following the Hewlett-Packard split in 2015, we are witnessing a widespread shift in industry operational dynamics and leading best practices, defining the imaging outlook of the future.

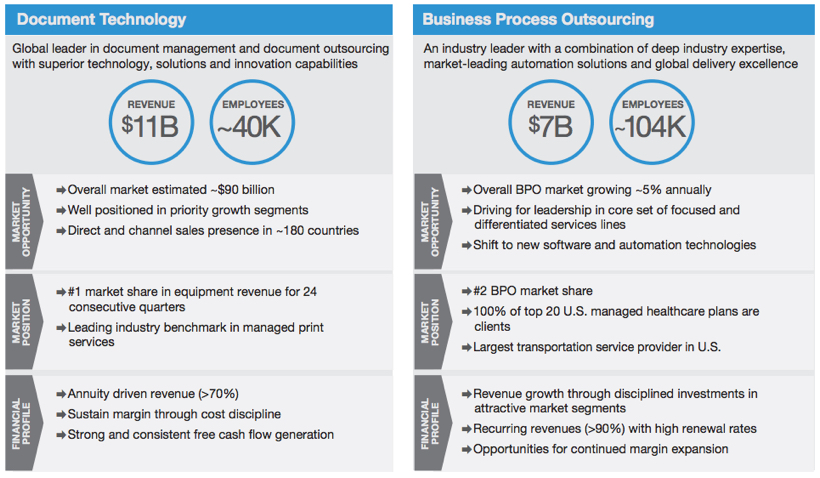

Similar to Hewlett-Packard, Xerox points toward a desire for increased focus as the primary factor leading to the decision. As indicated by current Xerox Chief Executive Officer (CEO) Ursula Burns, the business process outsourcing and document technology businesses have starkly different financial dynamics, requiring separate operating activities and mindset for success. In splitting the company into more targeted business applications, day-to-day operations and management can be tailored to best suit that segment, delivering increased opportunity for success.

A look at Xerox's two separate businesses.

The business process outsourcing business will separate from the document technology business, gaining a new CEO as well as an increased influential presence from Carl Icahn, who will gain three board seats in the new firm.

With two market powerhouses splitting, we are seeing a major shift in industry dynamics. The imaging industry has traditionally enjoyed incredibly rich profit margins for decades, driven by high-margin supply sales associated with device placement. Additionally, firms have sought to further increase profitability through offering high-end business process management and optimization services, extending beyond exclusive imaging expertise.

However, as the industry matures, increased competitiveness and market saturation abound. Along with imaging product and service commoditization, the increasing competitive landscape has led to steadily decreasing profit margins—a byproduct of the commonality of price wars as a primary sales tactic.

Because of decreasing profitability from intense market saturation, competitive advantage will increasingly shift to those firms who can achieve significant operational efficiency, along with extremely strong brand affinity. The ability to drive sustainable profitability through efficiency, rather than higher pricing, will become absolutely critical to long-term success, as page volumes and unit placements incur continued downward pressure.

To achieve the level of streamlined efficiency needed to drive sustainable success, an alteration in business-wide focus is needed. Leading by example, Xerox and Hewlett-Packard are communicating that a synergy between advanced business services and product management doesn’t work. As the industry continues to evolve, companies will increasingly be forced to choose whether to be “high value, high margin” or “high volume, low margin” businesses—requiring an increased level of focus and commitment, which is achievable only through simplification of the business model.

It is rather disappointing to see a reversal of strategy in action among the top competitors in the market. The Xerox split, along with that of Hewlett-Packard and a potential following from Lexmark, serves as a clear indication that synergies within the industry just won’t pan out. While we’ve seen a lot of great ideas coming out of companies like Xerox, execution, for whatever reason, hasn’t followed.

Taking these trends into consideration, the imaging industry is poised to look like that of cable television providers within the next five to 10 years—controlled by a few dominant players (developed from multiple industry consolidations and exits). They too will wrestle with new consumption models from customers, such as mobile and digital channels, seen in the cable industry today.

Overall, it is going to be a rough ride for a number of players in the industry, as we continue to experience disruption. Major company splits are only the beginning.

What do you think about the Xerox split? Leave a comment below to tell me what you think.

Mario Díaz is the vice president of consulting at Photizo Group, a global consulting and market intelligence firm, and has more than 25 years of strategic marketing and business development experience, including executive management positions at Apple, Avnet, Toshiba, IO Data Centers and QMS. For more, visit http://photizogroup.com.