point out that transactional printing is a declining market, but then again,

most printing markets are. Overall book manufacturing is shrinking; direct mail

is significantly down compared to its all-time high in 2006; magazines,

newspapers, you name it. The main difference with the transactional market is

that it is dominated by digital printing. In most other print markets, while

conventional ink on paper processes continue to dominate, digital print volume is

increasing to accommodate shorter print runs and just-in-time inventory. By our

estimation, in recent years, the transactional printing market in North America

has declined at a rate of about two percent to three percent per year—not a

disastrous decline but enough to shake things up. We recently reassessed the

transactional market in North America to gauge how it fared during and in the

wake of the recession.

Although the recession drastically

impacted direct mail and other print markets where spending is discretionary,

transaction mail initially fared better. There was clearly some impact as

transaction mailers consolidated mailings and, in some cases, cut back on the length

and frequency of statements but nothing compared to the drop-off in direct

mail. Over the last few years following the official end of the recession,

however, direct mail has picked back up, but transactional mail has not.

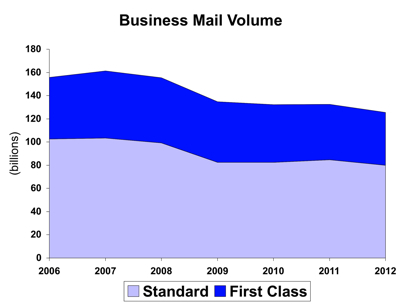

Top-line numbers for mail

volume in the US are down dramatically in recent years but don't necessarily paint

a very detailed picture. US domestic mail includes First-Class consumer mail

(single-piece), First-Class business mail (presorted transaction mail and

standalone First-Class advertising), Standard Mail (all of which is sent by

businesses) and miscellaneous other mail and packages. Each of these mail

categories, however, fared quite differently before, during and subsequent to

the recent recession. Electronic diversion clearly impacted consumer mail much

earlier and in more dramatic fashion than business mail. From 2006 to 2010,

consumer (single-piece) mail lost about 35% in volume, while business mail

(First-Class and Standard combined) lost about 15% in volume. From 2010 through

2012, consumer mail continued to fall precipitously at an annual rate of about

-9.0%, while the rate of decline for business mail slowed to about -2.5%.

First-Class business mail

is dominated by transactional mailings, such as bills, statements and confirmations.

Most of the advertising mail sent First-Class is in the form of ride-along

inserts with transactional documents. TransPromo has made relatively little

impact on insert volume since overall adoption has been modest. In addition,

insert advertising has benefitted from the US Postal Service's (USPS's) extra

ounce incentives. Standalone First-Class advertising, however, dropped

dramatically during the recession. First-Class secondary advertising (inserts)

decreased by only 0.3% between 2007 and 2009, while standalone First-Class

advertising declined by 26.4%.

|

Figure 1: First Class & Standard Business Mail Volume. 2006-2012 (Source: USPS data, INTERQUEST), Click here to enlarge image» |

From 2006 through 2010,

First-Class business mail declined in volume at an annual rate of about -1.7%,

while Standard Mail declined at an annual rate of about -5.3%. From 2010

through 2012, the rate of decline in Standard Mail improved to about -1.7. The

drop-off in First-Class business mail volume, however, has shown little to no

improvement and its rate of decline (-4.0% from 2010 through 2012) is more than

twice that of business mail. These numbers highlight the fact that First-Class

Mail volume is largely consumer-driven, and once consumers adopt paperless

bills and statements, they are unlikely to return to paper, while Standard Mail

volume largely reflects discretionary advertising expenditures.

During the recession,

advertisers quickly migrated to cheaper online media, but transaction mailers,

by necessity, continued to send bills and statements. Yet, the recession did

serve to reenergize the efforts of mailers to find ways to reduce the cost of

transactional mail and to entice customers to accept paperless delivery. So

while direct mail will probably grow as the economy improves (knock on wood), we

expect the decline in transactional print volume to accelerate to a rate of four

percent to five percent annually.

|

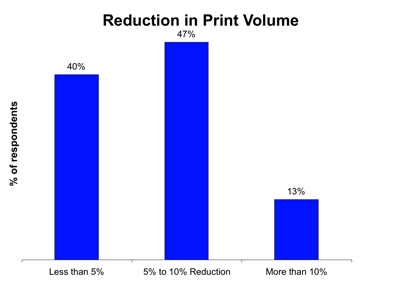

Figure 2: Estimated Reduction in Print Volume Due to EBPP (Source: INTERQUEST). Click here to enlarge image» |

We typically interview and survey the largest trans-actional providers

for our studies, since the market is top-heavy, with a relatively few major

players generating the majority of volume. For the most part, these providers

have weathered the downturn in transactional volume through consolidation and

by gaining volume at the expense of competitors and outsourcing. In recent

years, however, we see a heightened awareness among large providers of the

long-term impact of electronic displacement on print. In Canada, more than

two-thirds of the transactional print providers we recently surveyed indicate

they have experienced a negative impact from electronic bill presentment and payment (EBPP) on their

transactional print volume—up from 60% a year earlier. In the US, only about

one-third (32%) of the respondents indicate that electronic delivery has not

negatively impacted their transactional print volume, 60% say there has been

some impact on transactional print volume and the remainder are not sure. About

40% of the respondents indicate that the impact has been less than five percent

while about 47% estimate the impact has been from five percent to 10%.

Although a great deal of

attention has been paid to TransPromo, or using bills and statements as

delivery vehicles for promotional content, it is by no means making a significant

impact. It is growing but from a small base. It is, after all, very difficult

to do well, and not all providers or clients are willing or able to make the

effort. Beyond TransPromo, there are many opportunities in the use of full-color

inkjet printing to improve the legibility and effectiveness of documents and to

eliminate pre-printed forms. Most large transactional providers are also

offering a variety of other value-added services, such as EBPP and multi-channel

delivery.

The outlook for the transactional

market is not all gloom and doom, as many would have it. Volume will continue

to contract, as it will in many other print markets. It is, however, a very

important market—one of the largest served by digital printing and the source

of a recurring revenue stream for providers. Inkjet is making a big impact on

the market, and vendors of finishing equipment continue to innovate and improve

the manufacturing process. Numerous opportunities remain for both service

providers and corporate in-house organizations to reduce costs, increase

productivity and expand their service offerings, but they will have to do so in

an increasingly competitive climate.

DAVID DAVIS is a director for INTERQUEST, a market

and technology research and consulting firm in the field of digital printing

and publishing. He has more than 25 years of experience in the printing

industry and is the author of numerous industry reports, publications and

educational programs on a variety of industry topics. Contact Mr. Davis at 434-979-9945

or visit www.inter-quest.com.

Tweet