In the last issue of DOCUMENT, we focused on some macro trends in the transactional market in North America based on in-depth surveys we recently conducted with large third-party transactional operations and corporate transactional providers and buyers. Now, we take a closer look at the operational details based on our surveys.

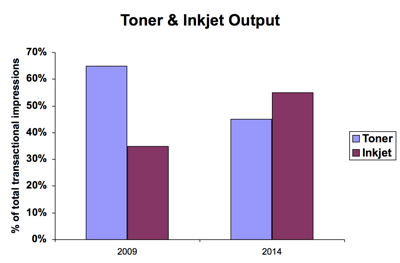

It’s no secret that high-speed inkjet printing has flourished in the transactional market. We find dramatic evidence of this in our surveys conducted in recent years. In 2009, when inkjet was beginning to establish a firm foothold in the market, slightly more than one-third of the transactional output reported by respondents was printed on inkjet presses. Five years later that percentage has jumped to well over half of the output.

Inkjet has dramatically changed transactional production. High-speed, roll-fed toner presses have traditionally been used for black-only output and for overprinting black variable data content onto preprinted shells, which typically carry a company logo or masthead. The practice is cost-effective but fraught with overhead related to stocking and handling preprinted rolls, which can quickly be rendered obsolete. Inkjet presses have made a big impact in overprinting and opened the doors to increased use of dynamic, full color to enhance documents and cross-sell services.

Three years ago, nearly two-thirds of the output produced by respondent companies was overprinted; in 2014, that percentage is down to about one-third—a dramatic change in relatively short order. Not all of the overprinting has transitioned to color, but a sufficient number has made this switch to reduce black-only impressions by about 20%. In our most recent survey, respondents indicate the top three trends they see in the market are the adoption of full-color printing, the migration to electronic delivery and “white paper factory” solutions, which are designed to eliminate preprinted forms with single-pass inkjet solutions.

Electronic diversion, postal issues and the rise of inkjet will continue to exert the biggest impacts on the market in coming years. Among respondent companies planning to acquire digital printing equipment in the coming year, the largest percentage plans to acquire continuous feed inkjet equipment; slightly less than one-fifth are considering cut-sheet inkjet equipment; and well under 10% are planning to purchase black-and-white continuous feed or cut-sheet, toner-based presses.

Although the transactional market will continue to contract, it remains a large and important print market. The decline in First-Class Mail has slowed as the economy has improved, and many households continue to prefer transactional documents to be printed, even if they are also delivered online. We expect transactional volume in North America to decline by three to four percent annually over the next five years; the decline in transactional mail pieces will be greater than the drop-off in transactional print volume due to continued consolidation of mailings.

It’s no secret that high-speed inkjet printing has flourished in the transactional market. We find dramatic evidence of this in our surveys conducted in recent years. In 2009, when inkjet was beginning to establish a firm foothold in the market, slightly more than one-third of the transactional output reported by respondents was printed on inkjet presses. Five years later that percentage has jumped to well over half of the output.

|

Figure 1: Transactional Output Produced on Inkjet Presses, 2009 & 2014 (Source: INTERQUEST, 2014) (Source: INTERQUEST, 2014) Enlarge image» |

Inkjet has dramatically changed transactional production. High-speed, roll-fed toner presses have traditionally been used for black-only output and for overprinting black variable data content onto preprinted shells, which typically carry a company logo or masthead. The practice is cost-effective but fraught with overhead related to stocking and handling preprinted rolls, which can quickly be rendered obsolete. Inkjet presses have made a big impact in overprinting and opened the doors to increased use of dynamic, full color to enhance documents and cross-sell services.

Three years ago, nearly two-thirds of the output produced by respondent companies was overprinted; in 2014, that percentage is down to about one-third—a dramatic change in relatively short order. Not all of the overprinting has transitioned to color, but a sufficient number has made this switch to reduce black-only impressions by about 20%. In our most recent survey, respondents indicate the top three trends they see in the market are the adoption of full-color printing, the migration to electronic delivery and “white paper factory” solutions, which are designed to eliminate preprinted forms with single-pass inkjet solutions.

Electronic diversion, postal issues and the rise of inkjet will continue to exert the biggest impacts on the market in coming years. Among respondent companies planning to acquire digital printing equipment in the coming year, the largest percentage plans to acquire continuous feed inkjet equipment; slightly less than one-fifth are considering cut-sheet inkjet equipment; and well under 10% are planning to purchase black-and-white continuous feed or cut-sheet, toner-based presses.

Although the transactional market will continue to contract, it remains a large and important print market. The decline in First-Class Mail has slowed as the economy has improved, and many households continue to prefer transactional documents to be printed, even if they are also delivered online. We expect transactional volume in North America to decline by three to four percent annually over the next five years; the decline in transactional mail pieces will be greater than the drop-off in transactional print volume due to continued consolidation of mailings.

David Davis is a director for INTERQUEST, a market and technology research and consulting firm in the field of digital printing and publishing. Its most recent study of transactional printing, "Digital Transactional Printing in North America: Market Analysis & Forecast (2014-2019),” is available. For more information, contact INTERQUEST at 434-979-9945 or visit www.inter-quest.com.