This article appears in the Winter 2019 digital issue of DOCUMENT Strategy. Subscribe.

Instead of relying on document editors and composition capabilities of these other systems, it makes sense to use a dedicated CCM solution that can be accessed from within that business system. Not only does this provide a much richer authoring or editing experience, it also offers better versioning, approval, and auditing capabilities, as well as the ability to centralize communications for more cost-effective production or true omni-channel output.

We’re seeing some examples of this type of seamless integration with Smart Communications and claims management system software provider Guidewire or the functionality of creating a communication natively within Salesforce using OpenText Exstream’s Empower Editor. Another example comes from Belgium-based Inventive Designers, which has integrated its online designer with a local campaign management deployed at a large Belgium bank. This allows marketers to create personalized communications from within the campaign management tool, irrespective of channel (e.g., print, email, mobile, etc.).

This move toward integration is introducing three big shifts in the marketplace. First, vendors are opening up their CCM solutions through dedicated and granular application programming interfaces (APIs), which can access every major part of their product portfolio. While most offer API access, there are varying levels of granularity when it comes to the true “openness” offered by these companies. A few examples of vendors known for providing deep functional access include Ecrion, Smart Communications, Topdown Systems, and Xpertdoc.

From a print and digital perspective for communications, products have been born out of the need to provide end-to-end integration between enterprise generation systems and multi-channel production fulfillment solutions, including dashboards that offer full control and insights for business users. Some good examples of these dedicated integration tools include Racami’s Alchem-e, the recently released RICOH Communications Manager, and Sefas with its Harmonie Suite Producer. Striata also operates in this space with a strong digital focus.

Vendors are also turning their product integration capabilities into dedicated integration platforms. Just look at OpenText’s newly released cloud solution OT2—an example of an integration platform as a service (iPaaS)—that offers low-code/no-code configuration of applications, which can be deployed quickly on the OpenText cloud. Furthermore, Quadient’s Inspire Scaler is a great example of technology that can connect to various enterprise IT systems, control behavior of communications, and elastically scale Quadient composition instances running in the cloud. Then there’s Adobe’s Experience System of Record that, coupled with its I/O development platform, allows data scientists to bring together data, content, and profile information across the entire customer experience solutions stack. CCM vendors may also turn to third-party solutions to build these kinds of platforms. For example, Doxee has built its integration platform on an iPaaS from Informatica.

While managed services from a deployment perspective is a big trend, we are also seeing vendors add additional services on top of their platforms—so that they increasingly act as a full communications services provider. Doxee, Messagepoint, Sefas (in France), Tecra Systems, and soon several others may offer additional services, such as composition, information design, data analytics, and other outsourced services, on top of their technology offerings.

In 2019, we believe that this technology and services landscape will further converge. Incumbent print service providers, such as traditional print and mail companies, are expanding their portfolios to offer digital services around a standardized CCM technology platform, often supported by homegrown development.

New entrants in hosted managed services (HMS) are another example of how this line between technology and CCM services is blurring. CEDAR Document Technologies, NEPS, and DataOceans have already been active in the US for several years, but we are now seeing companies like Canon (in Europe) or Ricoh (in the US) entering this space, as well as dedicated providers such as AIRDOCS (in Australia and the US) or HiperStream (in Europe). In the UK, we’ve seen accountancy firm EY (formerly Ernst & Young) come out with a dedicated HMS solution, powered by a Dutch services provider.

Before long, hybrid arrangements between technology and services providers, who operate together to solve specific business problems, will evolve into smart partnerships. With that, we will see a much stronger push to embed CCM solutions as part of a wider consultancy sell, which brings with it a significant risk for price erosion for those vendors that simply convert their licensed solutions to consumption-based pricing without linking their sales strategy to business value.

This is the next level of low-code/no-code application development. Instead of developing workflows based on drag-and-drop, a business user can tell the computer what to do and create (dynamic) business rules on the fly. In general, chatbots are a big area of focus. For example, Pitney Bowes launched EngageOne Converse initially as a deterministic chatbot but with the potential for embracing AI technology in the future.

Robotic process automation (RPA) is also an area that can benefit from machine learning, especially in customer service interactions, and this is where companies like Indian-based Intense Technologies are focusing their efforts. Also, Xpertdoc is investing in AI to turn legacy Microsoft Word forms into responsive HTML5 formats. Besides AI, we’re also seeing some early developments in blockchain development—mainly around securing access for archives and digital vaults—but this technology is still further out.

In many ways, 2018 was a year that demonstrated the rate of change in the market. As part of the wider shift, we’ve seen encouraging improvements in customer communications, as it has become increasingly embedded into the wider digital transformation evolution, thanks to new partnerships and a move toward a services-led approach.

©2019 Getty Images

With 2018 behind us, it’s that time of year when we reflect on the past developments that took place in our industry and to speculate on the technology innovations yet to come. We saw the emergence of three major trends in the customer communications management (CCM) marketplace this past year. Today, we take a look at how technology integrations, the evolving services-led business model, and the rise of machine learning and artificial intelligence will continue to impact the vendor landscape and change the CCM space as a whole in 2019.

1. Integration

As CCM is used more and more in conjunction with other enterprise information technology (IT) systems, we will see a strong demand for integration. Increasingly, CCM technology needs to be integrated with campaign management, content management, core business systems, or other enterprise IT systems—many of which have become more customer-facing themselves over the last few years.Instead of relying on document editors and composition capabilities of these other systems, it makes sense to use a dedicated CCM solution that can be accessed from within that business system. Not only does this provide a much richer authoring or editing experience, it also offers better versioning, approval, and auditing capabilities, as well as the ability to centralize communications for more cost-effective production or true omni-channel output.

We’re seeing some examples of this type of seamless integration with Smart Communications and claims management system software provider Guidewire or the functionality of creating a communication natively within Salesforce using OpenText Exstream’s Empower Editor. Another example comes from Belgium-based Inventive Designers, which has integrated its online designer with a local campaign management deployed at a large Belgium bank. This allows marketers to create personalized communications from within the campaign management tool, irrespective of channel (e.g., print, email, mobile, etc.).

This move toward integration is introducing three big shifts in the marketplace. First, vendors are opening up their CCM solutions through dedicated and granular application programming interfaces (APIs), which can access every major part of their product portfolio. While most offer API access, there are varying levels of granularity when it comes to the true “openness” offered by these companies. A few examples of vendors known for providing deep functional access include Ecrion, Smart Communications, Topdown Systems, and Xpertdoc.

From a print and digital perspective for communications, products have been born out of the need to provide end-to-end integration between enterprise generation systems and multi-channel production fulfillment solutions, including dashboards that offer full control and insights for business users. Some good examples of these dedicated integration tools include Racami’s Alchem-e, the recently released RICOH Communications Manager, and Sefas with its Harmonie Suite Producer. Striata also operates in this space with a strong digital focus.

Vendors are also turning their product integration capabilities into dedicated integration platforms. Just look at OpenText’s newly released cloud solution OT2—an example of an integration platform as a service (iPaaS)—that offers low-code/no-code configuration of applications, which can be deployed quickly on the OpenText cloud. Furthermore, Quadient’s Inspire Scaler is a great example of technology that can connect to various enterprise IT systems, control behavior of communications, and elastically scale Quadient composition instances running in the cloud. Then there’s Adobe’s Experience System of Record that, coupled with its I/O development platform, allows data scientists to bring together data, content, and profile information across the entire customer experience solutions stack. CCM vendors may also turn to third-party solutions to build these kinds of platforms. For example, Doxee has built its integration platform on an iPaaS from Informatica.

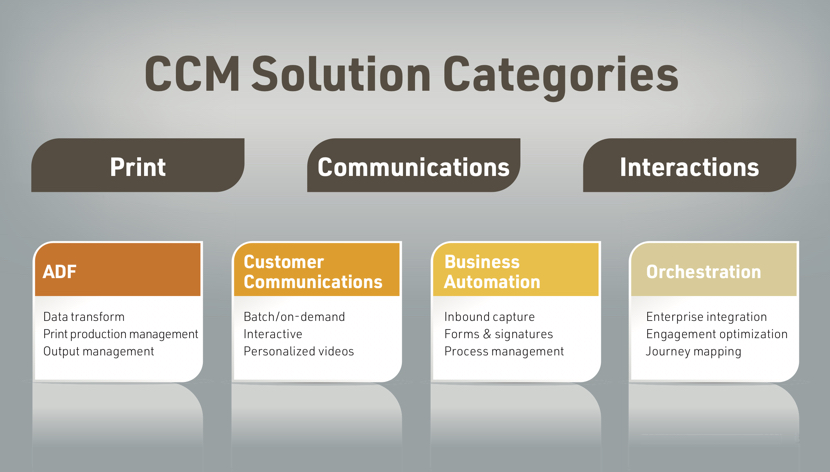

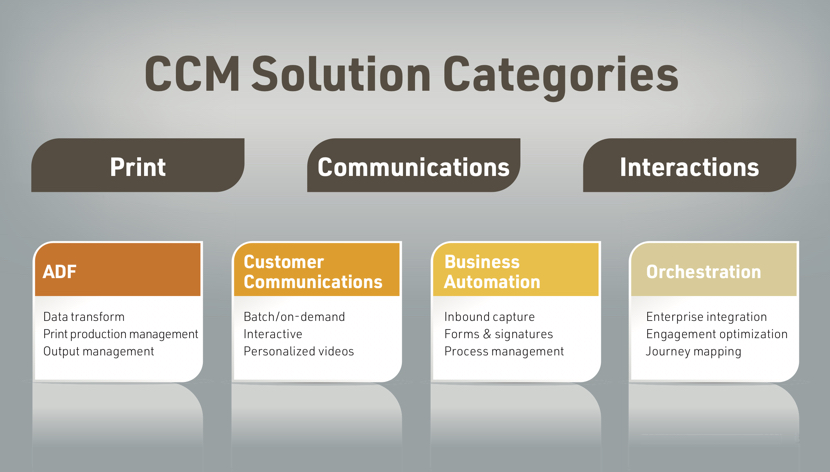

©2018/2019 DOCUMENT Strategy/Aspire Customer Communications Services

2. Conversion of Technology and Services

2018 was the year in which most major CCM vendors started to evolve their licensing model from selling on-premises licenses to hosted subscriptions. While early cloud adopters, such as Doxee and Smart Communications, already made that change a few years ago, we saw Pitney Bowes, OpenText, and Quadient adapt their models in 2018, indicating that deployment through the cloud, offering CCM as a service, and charging through a subscription model is certainly the way forward. Vendors, such as Compart, Pitney Bowes and others, are looking to modernize their architectures by embracing microservices and containerized deployment as well.While managed services from a deployment perspective is a big trend, we are also seeing vendors add additional services on top of their platforms—so that they increasingly act as a full communications services provider. Doxee, Messagepoint, Sefas (in France), Tecra Systems, and soon several others may offer additional services, such as composition, information design, data analytics, and other outsourced services, on top of their technology offerings.

In 2019, we believe that this technology and services landscape will further converge. Incumbent print service providers, such as traditional print and mail companies, are expanding their portfolios to offer digital services around a standardized CCM technology platform, often supported by homegrown development.

New entrants in hosted managed services (HMS) are another example of how this line between technology and CCM services is blurring. CEDAR Document Technologies, NEPS, and DataOceans have already been active in the US for several years, but we are now seeing companies like Canon (in Europe) or Ricoh (in the US) entering this space, as well as dedicated providers such as AIRDOCS (in Australia and the US) or HiperStream (in Europe). In the UK, we’ve seen accountancy firm EY (formerly Ernst & Young) come out with a dedicated HMS solution, powered by a Dutch services provider.

Before long, hybrid arrangements between technology and services providers, who operate together to solve specific business problems, will evolve into smart partnerships. With that, we will see a much stronger push to embed CCM solutions as part of a wider consultancy sell, which brings with it a significant risk for price erosion for those vendors that simply convert their licensed solutions to consumption-based pricing without linking their sales strategy to business value.

Trying to figure out the CCM vendor landscape? The Aspire Leaderboard is a free, interactive, online tool that dynamically visualizes the CCM vendor landscape. Visit the tool at www.aspireleaderboard.com.

3. Artificial Intelligence & Machine Learning

Undoubtedly, the impact of machine learning and artificial intelligence (AI) heavily influenced emerging technologies in 2018. This is clearly reflected in current offerings from vendors. Both Adobe and OpenText provide powerful AI engines through dedicated products called Sensei and Magellan, respectively, with capabilities ranging from pattern recognition, content optimization, channel attribution, and next-best-action suggestions. Messagepoint focuses on content analysis, template rationalization, and conversion of legacy templates into their modern Messagepoint format. In addition, Austrian-based ISIS Papyrus uses AI to optimize approval and case management workflows as well as to build business applications based on conversational (human to chatbot) interactions.This is the next level of low-code/no-code application development. Instead of developing workflows based on drag-and-drop, a business user can tell the computer what to do and create (dynamic) business rules on the fly. In general, chatbots are a big area of focus. For example, Pitney Bowes launched EngageOne Converse initially as a deterministic chatbot but with the potential for embracing AI technology in the future.

Robotic process automation (RPA) is also an area that can benefit from machine learning, especially in customer service interactions, and this is where companies like Indian-based Intense Technologies are focusing their efforts. Also, Xpertdoc is investing in AI to turn legacy Microsoft Word forms into responsive HTML5 formats. Besides AI, we’re also seeing some early developments in blockchain development—mainly around securing access for archives and digital vaults—but this technology is still further out.

In many ways, 2018 was a year that demonstrated the rate of change in the market. As part of the wider shift, we’ve seen encouraging improvements in customer communications, as it has become increasingly embedded into the wider digital transformation evolution, thanks to new partnerships and a move toward a services-led approach.

Kaspar Roos is the Founder and CEO of Aspire Customer Communications Services, an international technology advisory firm specializing in customer communications transformation and customer engagement optimization. Before starting Aspire, he ran InfoTrends’ global production workflow and customer communications advisory service. Follow him on Twitter @kasparroos.