For the past several years, we have watched as chart after chart shows the downward trend of the worldwide imaging industry. Whether you look at unit shipments, average selling prices or revenue, most of the trend lines are down, some more than others. While working on Photizo’s 2014 ink and toner forecasts, which we just released, I had the opportunity to dig a bit deeper into the numbers and saw the genesis of a trend worth watching.

MORE: Office Color Printing: Business Inkjet vs. Color Laser

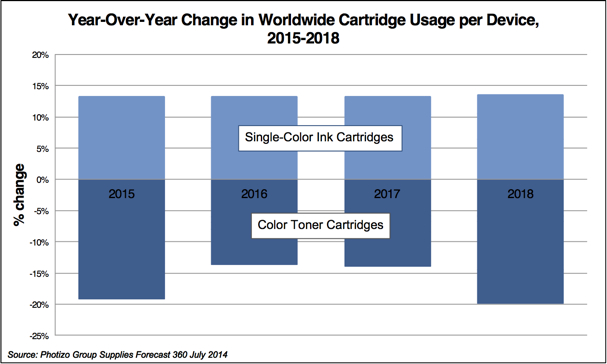

During the next two years (2014 and 2015), Photizo Group expects worldwide single-color ink cartridge shipments and revenue to increase in the low single digits, while single-color ink cartridge usage per machine is expected to rise over the next five years. Contrast that with the color (CMY) toner cartridge market, which we forecast to decline worldwide in all three areas: cartridge shipments, revenue and usage per machine.

One possible explanation for this situation is the rise of business inkjets, which are among the types of inkjet printers and multifunction printers (MFP) that use single-color cartridges to help reduce per-page costs. The office printing market is ripe for the picking for business inkjet companies, and stemming the tide of declining page volumes is certainly another incentive for manufacturers. With the price/performance offered by the latest round of business inkjet machines—especially the page-wide array models—I believe that users will buy these devices to print more pages for less money than a comparable entry-level color laser.

So, pages will naturally shift from color toner-based machines to ink-based models, with perhaps even a bump in page volumes per device due to the combination of fast print speeds and lower cost per page (CPP) offered by business inkjets. From 2014 to 2018, we expect the annual worldwide usage of color toner cartridges to decrease by 20%, from 4.2 to 3.3 cartridges per device, as usage of single-color ink cartridges increases by 14%, from 1.74 to 1.98 cartridges per device. At first glance, these changes may not seem significant, but when you look at the global installed base of color laser printers and MFPs (approximately 43 million in 2013), the numbers add up quickly. Moreover, the installed base of inkjet machines that use single-color ink cartridges was nearly 376 million worldwide in 2013.

Now, I’m not trumpeting the business inkjet as a panacea for what ails the imaging market—there are simply too many other factors, like mobile devices, digital workflow and the “less paper” mindset of Gen Y, that are dragging down overall page volumes. I am saying, however, that in a market that is tired of hearing about less printing, declining pages and fewer opportunities for growth, business inkjet machines have the potential to turn those frowns upside down.

Now, I’m not trumpeting the business inkjet as a panacea for what ails the imaging market—there are simply too many other factors, like mobile devices, digital workflow and the “less paper” mindset of Gen Y, that are dragging down overall page volumes. I am saying, however, that in a market that is tired of hearing about less printing, declining pages and fewer opportunities for growth, business inkjet machines have the potential to turn those frowns upside down.

For more information, visit photizogroup.com or follow Ann Priede on Twitter @ahpriede.