Sure, that purchase price at the cash register is appealing, but what about when you go back for that set of replacement toner cartridges? Well, that can set you back several hundred more dollars; in fact, you could well be paying more for those additional supplies than you did for the MFP.

So, what’s a user to do?

For several years now, we’ve been hearing about how business inkjet machines are going to make a run at the entry-level color laser market, but like “the year of color,” it’s been a long time coming. HP has been leading the charge, with Memjet jumping on board, and Epson recently joining the party.

With chants of “half the price of color laser” ringing in my ears, business inkjet vendors are clearly staking claim, and turning up the heat on color laser printers and MFPs—and with good reason.

- HP, with its vast number of laser printers shipped around the world—the firm announced the shipment of its 200 millionth LaserJet in November 2013—is not reaping the full rewards of this installed base because Canon gets a cut of every laser printer shipped...and every toner cartridge sold;

- Epson, with a fiercely loyal customer base, has been especially hurt by the declining photo printing market, where the firm enjoyed a leading market position and reaped the benefits, and profits, of those full-color pages; and

- Memjet, with its ongoing struggle to break into the old-boys club that is the imaging industry, needs to make a powerful statement to gain share and acceptance.

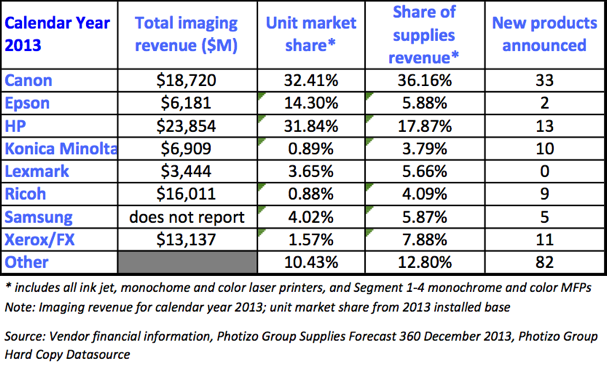

Figure 1

Today, Canon is the clear leader in office supplies revenue (see Figure 1), and if current market trends continue, the firm will retain that spot for the foreseeable future, with HP a distant second and remaining vendors fighting for a share of what’s left. If, however, HP can accelerate the adoption of business ink jet machines, like its Officejet Pro X and Officejet Enterprise MFPs, the imaging supplies landscape will have quite a different future and potentially a new supplies revenue leader. Add Memjet’s managed print services play and throw Epson into the mix, with its new WorkForce Pro 5000 series and WorkForce Pro RIPS (Replaceable Ink Pack System), and the office color laser market is facing some major threats to the status quo.

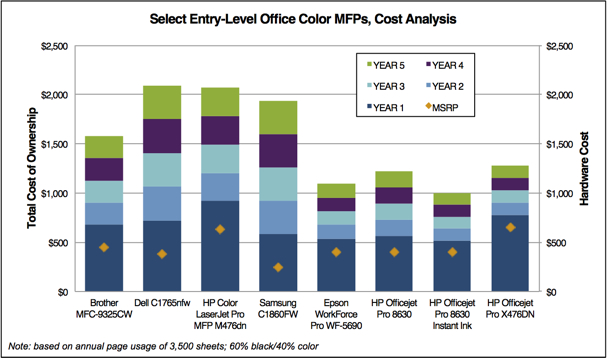

Figure 2

While simple arithmetic shows us that business inkjets are less expensive to purchase and operate than their color laser alternatives (see Figure 2), a number of factors are combining to give business ink jets an even more compelling message for office users.

1. No muss, no fuss.

HP’s Instant Ink subscription model offers users the ability to pay a set price per month and have supplies automatically delivered to their door, and the kicker is that users will pay less with a subscription than if they drove to the store and purchased the supplies themselves! Users benefit from the convenience and savings, and HP benefits from a steady, predictable revenue and profit stream.

2. Look Ma, no hands!

The supplies yields of the new crop of business inkjets are higher than that of comparable color lasers, leading to fewer interventions. Epson’s WorkForce Pro RIPS models use ink bags that supply an astounding 75,000 black pages and 50,000 color pages. The typical entry-level office color MFP user will never have to replace them!

3. At your service.

These business inkjets lend themselves well to managed print services (MPS) engagements as they offer comparable performance and real cost savings and the vendor assumes the risk, addressing any user concerns about the reliability and quality of inkjet—yes laser bias is alive and well!

So, do business inkjets have what it takes to move en masse from the marketing hype machine to the desktops of office users? Photizo Group firmly believes so, and here are three reasons why.

First, laser vendors will soon have to address profitability issues on low-end devices. Like the bundled inkjets that vendors used to toss in “for free” back in the day, today companies often sell color lasers at a loss and look to high-margin supplies to turn a profit over the life of the machine. More and more buyers are experiencing “sticker shock” when the cashier rings up those replacement supplies at the local office superstore, and with their lower cartridge prices, business inkjets offer a ready antidote.

Second, MPS offerings will help to further build momentum, as companies can place business inkjets as part of an MPS engagement and simply offer users an affordable color MFP as part of the package. After all, how many users actually know if their printer is inkjet or laser? As long as the machine gets the job done reliably, affordably and with acceptable quality, the technology is really irrelevant.

I’m tempted to think about those blind taste tests where consumers are asked to choose their favorite brand of cola, yogurt, etc. and are surprised to learn that their preferred choice is actually the perceived “lesser” of the two. Business users suffer from a similar kind of predisposition, called laser bias, when it comes to printing technology, and I believe that if color lasers and business inkjets were “put to the test” in a similar kind of side-by-side comparison, inkjet would win out, and office users would be forced to stop playing favorites.