This old adage is more

than a saying—it's a powerful aspect of human nature, especially in our data-

and incentive-driven world. In fact, at times, it may even be too powerful. While

business process measurement is critical, managing by measurements alone can

result in unintended consequences.

Some people say, "If you're not

measuring, then you're only practicing." Which is it for you?

There are literally

hundreds of sources touting various types of measurements, including specific metrics

for different business processes and industries. Public company stock analysts,

and companies themselves, may report key measurements in their Form 10-K annual

report to shareholders and as part of their quarterly press releases and

analyst conference calls. Many industry associations report measurement information

on their members, often to help their membership improve the relevant areas of

their business overall and within specific business processes. Organizations

should seek out such information and find the best sources and concepts that

can help them be more effective.

However,

the measurements an organization selects and uses must work for its unique

demands and circumstances. They have to help executives, department leaders and

individual business owners manage better, make more accurate decisions and

improve performance more distinctly and faster.

A few basic types of business

process measurements include:

- Input

- Quality

- Process

- Cost

- Output

- Time

These measurements relate to

many things, e.g., price, volume, mix, innovation and compliance, among other

things.

Measurements in a vacuum are just that—empty. They become meaningless, or worse, counter-productive

when there is no comparative context. For measurements to be meaningful, there

must be something against which to compare them, for example, last year, last

month or even yesterday. Desirably, an organization's key measurements should

be linked to the strategy and business plan, and targets should be set.

Comparisons to similar

branches or individuals within groups, such as sales, production or service, will

yield results to help the organization improve. While comparisons to goals,

budgets and targets, including stretch targets, all will help management make

better decisions and take timely corrective action.

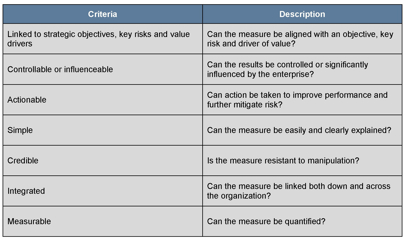

Measurement Key Indicator Characteristics Click here to enlarge image» |

Before measurements can be

finalized, they must be screened to ensure they meet the requirements of a key

indicator versus a mere operating or financial statistic. To be selected as a

key indicator, the measurement must possess all seven characteristics.

In

addition, benchmarking measurements with other companies—peers, competitors and

leading-edge and world-class organizations, should not be overlooked. In fact,

holding a benchmarking session or roundtable in one or more of the

organization's local markets may help it refine and improve its measurement processes,

as well as set new goals around key measurements.

Finally,

measuring is not a destination, but rather a journey. Organizations should

adopt the concept of continuous improvement into their thought processes and

"never be fully satisfied"—there is always more to be done and higher levels to

achieve. Making big plans, setting tough goals and almost getting there is generally

much better than simply settling for and achieving smaller, less lofty goals. Any

company would be well-served to "shoot for the moon" and see how close it can

come. Think of measurements as an

alignment tool. They help align processes and people with the organization's

strategy and business plan.

With company ERP systems, the Internet, spreadsheets, data warehouses and other enhanced

data sources, the ability and capability to measure have increased exponentially

because of all of the data available. This allows a company to connect much

more information than in the past in the form of key measurements. Organizations

should take advantage of this technology to generate real-time, continuously

streaming information where that degree of timeliness is warranted.

More and more

organizations today are adopting continuous monitoring, data mining and data

analytic techniques to improve their management capabilities. However, it is

important that they avoid taking this approach too far. Not every measure a

company develops needs to be reported daily or more than daily.

Too many

measures can be just as bad as too few. For this reason, the use of a "balanced

scorecard" is best practice when assessing measures to look at and act upon.

Both words, in fact, are important. Balanced reflects an appropriate and

action-compelling mixture of financial and non-financial measures, each

compared to relevant targets and other time periods within a single, concise

report. Scorecard denotes the ability to glean important, actionable

information swiftly.

One

important measurement of a balanced scorecard is length: If the scorecard

cannot fit on to one piece of paper (two-sided printing is acceptable), then

there likely are too many measures and too much information. Another important

element is presentation. When it comes to an effective scorecard, "A picture is

worth a thousand words." Organizations should incorporate rich colors and graphics

to make their scorecards as visually appealing as possible. Finally, no

scorecard will work if it is not accurate. Organizations must delve into the

integrity of the numbers and information that drives their scorecards and be

sure they have accuracy. Making what seems to be the right decision on the wrong

information can be catastrophic—data integrity matters. The goal is to ensure

"one version of the truth" so that decisions can be made in a timelier manner.

Most measurements are related to various business "objectives," such as profit, return on

investment, cost, opportunity, efficiency, etc., but what about the other side

of the coin—risk? Recently, risk measures have become an added dimension to businesses

and the business process landscape. In fact, public companies today must

disclose the role of their board in the risk oversight process. This means that

something must actually exist (a risk management process) in order for that something to be overseen. This is

critically important considering that missteps in the financial services

industry, resulting from ineffective or lack thereof risk management processes (and

measurements), continue to dominate the news. It is the task of all process

leaders to consider the question, "What can go wrong?" As part of this, there should

be some risk measurement, monitoring and reporting activity.

While

some will surely disagree, businesses and their key processes are more than

just measurements. There is a human element that shouldn't be forgotten and one

that organizations may not be able to measure fully. Business is still about

people: If companies can harness enthusiasm, dedication, commitment and loyalty

from their people, all of the other measurements will come. Thus, while it is

important to measure and measure well, it also is vital to think beyond

measurements and consider the human aspects of any organization and the people that

management oversees, controls, influences, develops and leads.

Finally,

remember the carpenter's rule: "Measure twice, cut once."

BOB HIRTH is executive vice president for Protiviti, a global

business consulting and internal audit firm. His responsibilities for the last 10

years have included providing leadership, strategic direction and practice

infrastructure support for Protiviti's global Internal Audit and Financial

Controls practice. For more, visit www.protiviti.com.