"Where should I invest?" is a critically important question for you

and your company. On a personal level, the answer will determine how

comfortable your retirement is. On a corporate level, the answer influences

whether your company survives and thrives.

Every year, pundits offer their thoughts on the "next big thing," such

as cloud, big data and social media. Coverage of the next big tech investment

trend moves from the business media to a fascinated general audience, resulting

in a wall of noise that is amplified and can make corporate decision makers

suspend rational judgment in favor of novelty or the fear of being left behind.

Think of the "Dot Com Era" around the year 2000 and what we now

know of as "web-to-print." Hundreds of start-ups flush with venture capital

promised to revolutionize how print was created, bought and managed. Printing

companies would be disintermediated and reverse auctions would drive out costs—except

for the big fees the dot-com companies planned to collect ("taxes" the printing

companies called them). Despite the hype, most of those dot-com companies

folded without gaining traction. Yet, many of their core procurement concepts lived

on and morphed into viable products. Ten years later, we have a thriving,

mature web-to-print market.

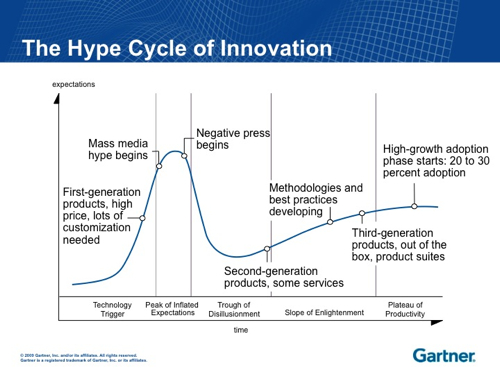

Web-to-print followed Gartner's Hype Cycle curve from inception to over-enthusiasm

and through a period of disillusionment to the market's eventual adoption of

the technology in some form (see figure 1.) As the curve illustrates, if an

investment is made too soon, then you may suffer through the painful and

expensive lessons associated with an immature technology. One the other hand,

if an enterprise delays action for too long, then it runs the risk of being

left behind by competitors that succeed in making the technology work to their

advantage.

Each year, Gartner creates nearly 100 Hype Cycles as a way for

clients to track technology maturity and future potential. Analysts worldwide

position the technologies on the Hype Cycle based on a consensus assessment of

hype and maturity. We evaluate a variety of relevant market signals and

indicators to determine where technologies are along the curve. Some inputs are

quantitative but overall the Hype Cycle is a structured, qualitative research

tool.

To illustrate the Hype Cycle concept and why it is a valuable strategic

planning resource, let's consider context-enriched content and 3D printing.

Context-Enriched Content

Hype Cycle Position: Technology Trigger

Market Penetration: 1% to 5% of Target Audience

Maturity: Emerging

Sample Vendors: Dai Nippon Printing; HP; Oracle; Pitney Bowes;

Saepio; Salmat; SDL; Xerox

To understand context-enriched content requires a brief description

of what we mean by "context." Simply put, context is the relevant facts about

current conditions that are true in the moment but may not be true in the

future.

Many people assume, often after using a smartphone or tablet to

find a nearby restaurant or business, that context equals location. However,

context may also include information inferred from the user's movements, social

media activity, proximity to other devices and recently accessed content. On

the other hand, the recipient's name, address, credit limit, account number and

status are not context data but reference data that are more or less permanent

characteristics with respect to a particular use.

Context-enriched content (CEC) is defined as the content,

information and data ranging from articles to advertising based on the user's

context that is served to whatever medium the recipient is using. The media may

be a web browser, a mobile phone, a media tablet or printed materials. CEC is

differentiated from traditional communications by incorporating an

understanding of the user's context and needs in the moment.

A common marketing message that is not "context-enriched"

is the bill you receive by mail. A paper bill is limited to "transpromo"

messages that are based on your purchasing history. But when you access the

same information with an iPad, for instance, the biller now knows your

location, time of day and recent (even same-day) transactions, in addition to

past purchasing history. The context-enriched result is targeted,

individualized content that is relevant to you in that moment.

Our advice to technology providers is to leverage their core customer

communications management software offerings to build a publishing platform

that serves up relevant content to Internet, print and mobile device users with

negligible data transfer latency and strong security. For enterprises, your

first application of context-enriched content should be a consumer-focused one

that publishes the highly personal and targeted information that the prospect,

customer or constituent requires. Engage leading-edge providers to develop prediction

algorithms that serve relevant content based on context while ensuring privacy

and security.

3D Printing

Hype Cycle Position: At the Peak of Inflated Expectations

Market Penetration: 5% to 20% of Target Audience

Maturity: Adolescent

Sample Vendors: 3D Systems; Asiga; Beijing TierTime Technology;

Blueprinter; Fab@Home; HP; Leapfrog; MakerBot; pp3dp; RepRap; Stratasys;

Ultimaker

3D printing is defined as a method of converting 3D model data into

a physical, geometrically complex, intricately detailed and potentially

functional model or salable new or replacement part. 3D printers deposit ink,

resin, plastic or another material to build a physical model.

Gartner research focuses on the growing number of 3D printers that

cost less than $20,000.

Industrial 3D fabricating technologies for product prototyping and

short-run part manufacturing have been available since the early 1980s.

Continued quality improvements and price decreases mean enterprises can justify

a modest investment that streamlines their product design and development

programs. 3D printers with multicolor capabilities (less than $15,000) and

single, monochromatic 3D printers (under $10,000) are available for a wide

range of applications, with simple build-your-own-printer kits costing a few

hundred dollars appealing to enthusiastic experimenters.

A sign of the market's growth and maturation is the consolidation

of its technology providers. In 2012, 3D Systems completed its acquisition of Z

Corporation and Stratasys announced its intention to acquire Objet.

Interestingly, the major 2D printer manufacturers basically remain on the

sidelines, mainly conducting research or providing their OEM capabilities to

third parties. HP is the only 2D printer provider with a 3D product offering (DesignJet

printers built by Stratasys), although Xerox and Ricoh have demonstrated Objet

printers at major printing technology exhibitions.

3D printers remain an "adolescent" technology with a

tremendous amount of hype around 3D printing and what it can or cannot do. Uses

for 3D printers have expanded as advances in 3D scanners and design tools make

3D printing practical. Lower capital and operating costs mean the potential

benefits are high enough for many organizations to justify the modest

investment needed to experiment with 3D printing.

Gartner advises enterprises to explore the use of 3D printing

technology in product design and rapid prototyping, as well as for focus groups

and marketing campaigns. For their part, printer technology providers must

continue their research and development work while monitoring competitors'

acquisition and go-to-market initiatives.

In closing, bear in mind these two important points about Hype

Cycles:

- Technologies inevitably progress through a pattern of over-enthusiasm

and disillusionment, followed by eventual productivity - Be selectively

aggressive and move early with technologies that are potentially beneficial to

your business

PETE BASILIERE

is research director in the technology

and service provider organization of Gartner. For more, visit www.gartner.com/Pete-Basiliere.