In March of 2022, Macrosoft conducted its second annual CCM Industry Best Practices Survey. A total of 253 individuals from more than 88 identified companies participated in the survey — a diverse group across multiple companies and industries with robust responses. Here is what they found:

Survey Findings

Survey Findings

Summary of Key Insights from the Survey

1. We see more companies are transitioning from having separate CCM platforms to a single cross-channel, integrated CCM platform.

2. Organizations are trying to avoid ‘one size fits all’ batch approach to communicate with their customers. Trends are to communicate on the channel desired by a customer, at the time and in the format desired by the customer.

3. More and more companies are now doing all CCM work internally except for the actual printing services.

4. It’s good practice for organizations to carefully analyze ROI when integrating CCM, not just ROI as a company but across all departments to make sure optimal usage of the CCM platform.

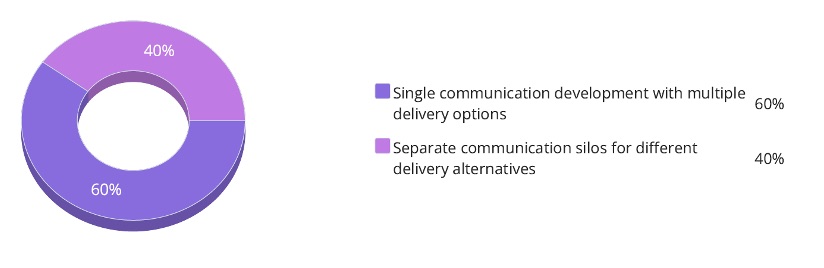

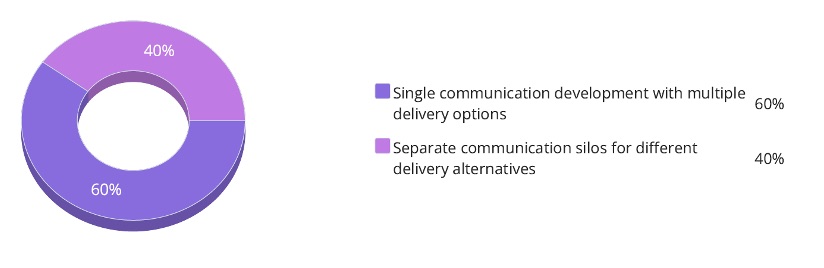

Does your CCM system have the nuance of a "create once and reuse many" methodology?

60% of participants have a single development CCM platform that enables multiple communication channels. This is defined as creating communication within a single platform but delivering it and reusing it across multiple business functions, channels and devices. This includes, for example, template development for print with reuse for digital delivery. 40% of participants indicated their company has separate CCM silos. Thus, these companies need to develop separate creativity for each delivery channel.

Data Trend

Participants having a single CCM platform increase from 50% in 2021 to 60% in 2022, while those who have separate platforms drops from 48% in 2021 to 40% this year.

Analysis

The industry is heading in the right direction with over half of the companies having single CCM platforms. We also see this number increase significantly compared to 2021, which means more companies are transitioning to single platform CCM. We expect to see this trend in the coming years. On the other hand, those companies with multiple CCM platforms are doing significantly more work as each communication type needs to be developed by (separate) designer teams. It also introduces compliance risks of nonmatching results based on the delivery channel. Having separate communication CCMs means more overall work, less message coordination, more inertia in work processes and greater risk of mis-messaging.

There is the best opportunity in the marketplace for use of dynamic communications being delivered to the audience across print PDF, web delivery, text message, fax and other delivery mechanisms. Companies not yet developing in this fashion have a tremendous opportunity for rationalization of development effort and consolidation of creative platforms.

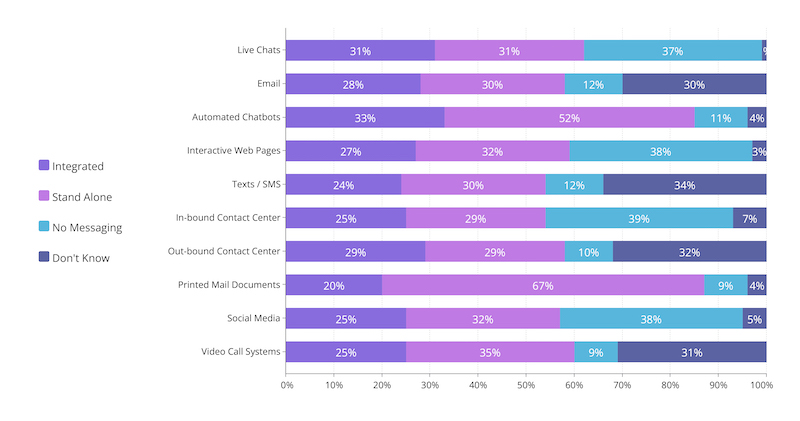

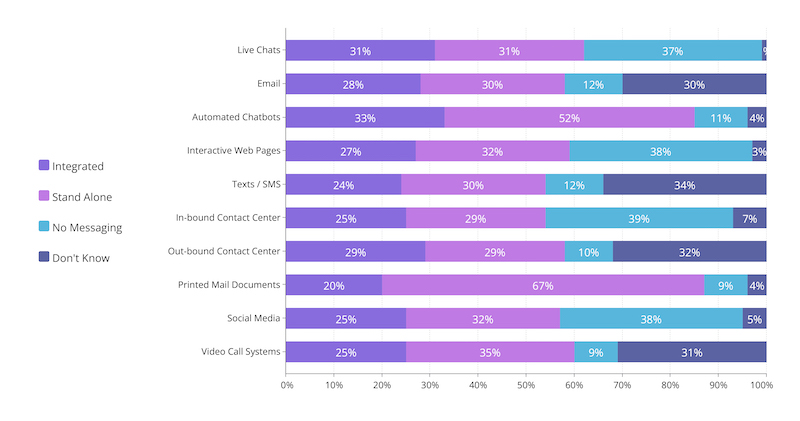

Are the following systems integrated cross platform or standalone?

Survey Findings

Participants were asked to identify, for each of the 10 different communication platforms identified, if their company had integrated messaging or standalone messaging. Averaging across all 10 platforms, 27% of respondents indicated they are cross-platform (integrated) whereas 37% are standalone. The lowest integration percentage was identified for printed mail documents.

Data Trend

Average integrated rate increased from 26% last year to 27%, and the average standalone rate decreased from 49% to 37%.

Analysis

We see a slight increase for companies integrating their CCM platform but a huge decrease in the standalone functions. Taken together with the observation we found in the previous question, the two sets of results both indicate companies are moving towards integrating all communication to a single cross-platform channel to track and optimize customer journey maps. In today’s world, customer expectations are: they contact the company, the service rep will know what interactions have already happened and what is the status of the issue. The customer wants to have seamless interactions across website chat, call centers, printed information, social media and video call systems. Companies who invest in knowing the customer journey map are going to win more clients and retain and grow the clients they already have. So cross-channel, integrated communications is the logical way to proceed for the foreseeable future.

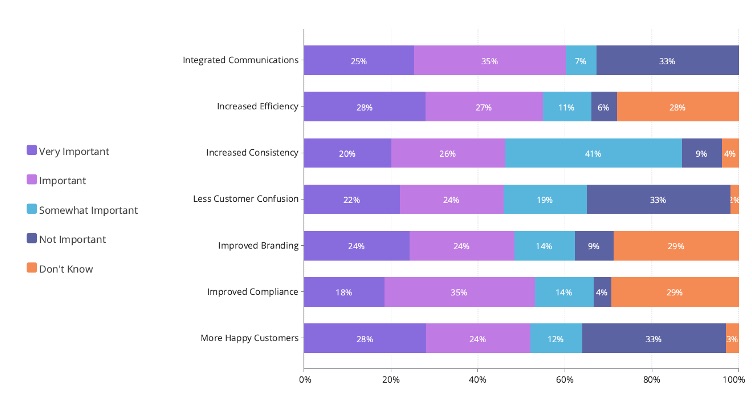

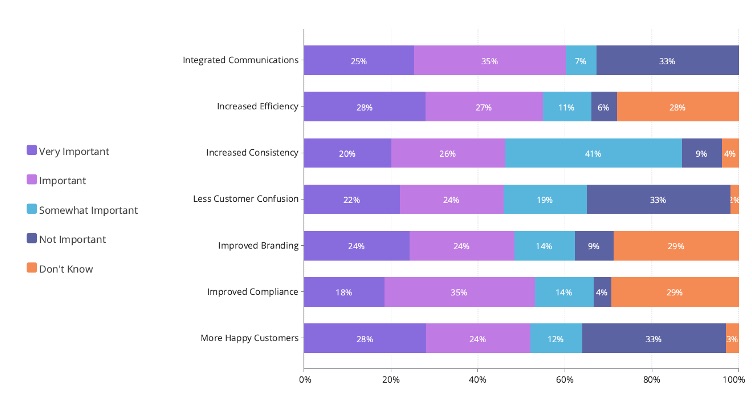

What benefits are most important to you with effective customer communication management?

Survey Findings

The top three choices with important benefits are “increased consistency,” “integrated communications” and “improved compliance.” Meanwhile, many participants chose Not Important for “improved branding,” “more happy customers” and “less customer confusion,” making them the least three important benefits.

Data Trend

The top three important benefits remain the same — “increased consistency,” “integrated communications” and “improved compliance.”

Analysis

Even though the most important benefits stayed the same, last year those who considered these benefits to be important, if not very important, were clearly the vast majority. This year the average rating for this number drops considerably. This indicates the ever-changing and fast-growing CCM industry values more benefits than those we listed above this year.

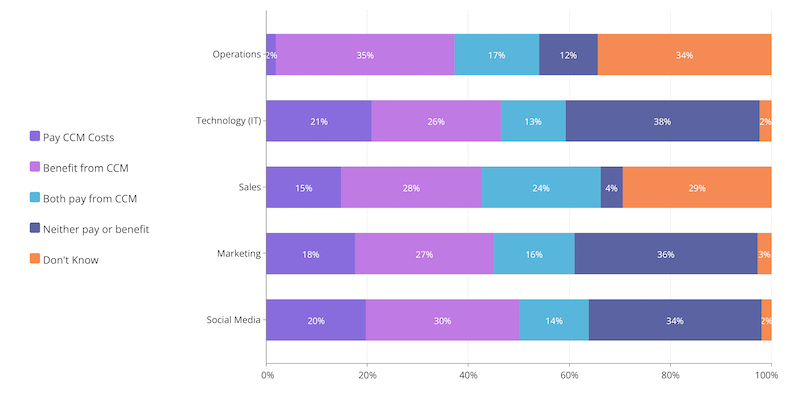

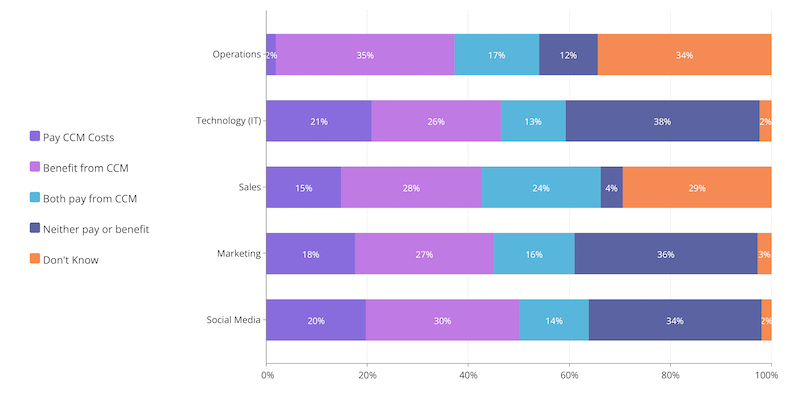

Indicate how the following functions contribute to or benefit from CCM activities at your organization

Survey Findings

In terms of paying CCM costs, IT has the most votes at 21%. Both Operations and Social Media ties at 30% votes saying they are benefiting from CCM. Sales have the most votes with 24% for both pay and benefit from CCM. Meanwhile, IT, Marketing, and Social Media get above 35% votes on neither pay or benefit from CCM.

Analysis

This is a new question for this year’s survey. In many companies the functions that pay for CCM often differ from the functions that benefit from CCM. The results show a variety of opinions on who’s paying and who’s benefiting. This could be caused by companies from different industries with their different use cases for CCM platform.

The result also put out a reminder that it’s necessary for organizations to carefully analyze ROI when integrating CCM, not just ROI as a company but across all departments to make sure of optimal usage of the CCM platform.

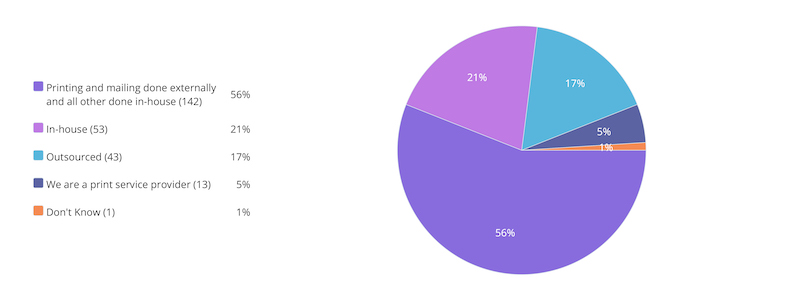

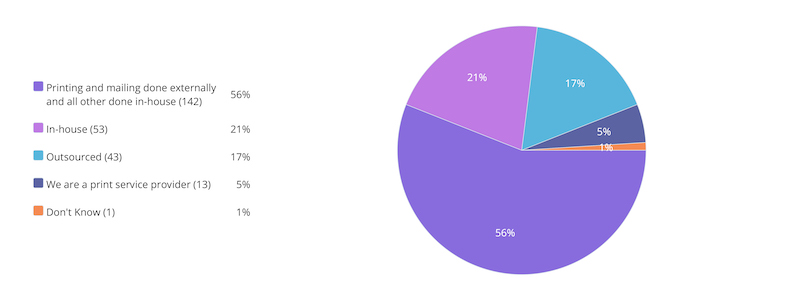

Are your communications produced and distributed by an outsource partner like a print company, or do you do that in-house?

Survey Findings

Total of 77% of respondents develop their CCM assets and communication workflows in house, although 56% of those then send the completed communications to an external print vendor for delivery to the recipient. 17% completely outsource the communication development and delivery process to third party vendors. 4% of survey participants self-identify as print service providers.

Data Trend

Total percent of companies develop CCM assets increased from 73% to 77% and those who then seek an external print vendor also increase from 48% last year to 56%.

Analysis

The result confirms our two expectations last year that the percent of companies doing all CCM work in-house (except printing) will continue to grow over time and in-house printing will continue to decline. Combined with two years of survey data, it is clear most respondents are now doing all CCM work internally except for the actual printing services, and a quarter of the respondents indicate their company is still doing the print service in-house. In our view, these survey results essentially confirm the standard industry business model. Companies that completely outsource communications development and implementation are in the minority (17%). In our opinion, these companies are missing an opportunity to ensure optimal messaging and to monitor that precise compliance is followed. CCM communications need to be developed and enhanced in-house. Use of an external print delivery provider is common.

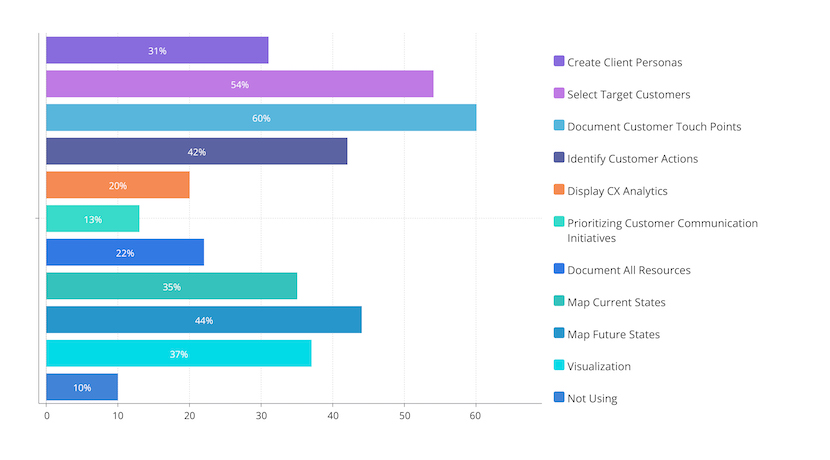

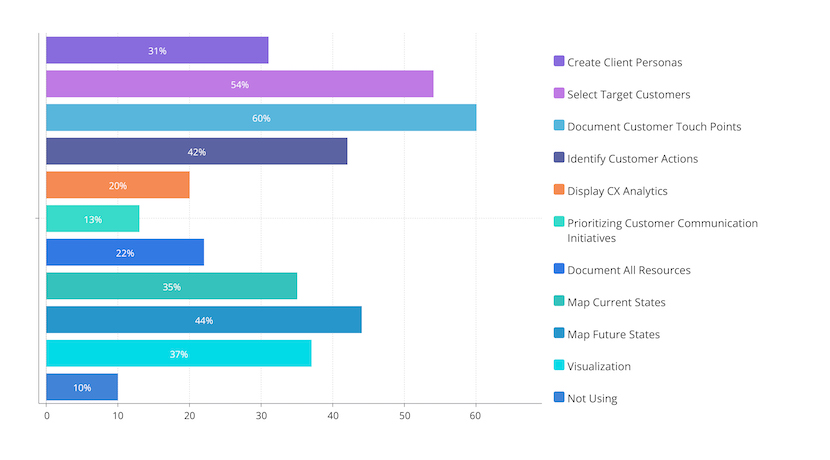

If you are using customer journey mapping within your CCM operations, how are you using it?

Survey Findings

We listed 10 use cases for customer journey mapping and the top 5 ways companies are using customer journey are:

1. Documenting Customer Touch Points at 60%

2. Selecting Target Customer at 54%

3. Map Future State at 44%

4. Identify Customer Actions at 42%

5. Customer Journey Mapping Visualization at 37%

Analysis

Last year we were very surprised and excited to find out 54% of participants today are performing customer journey maps and another 31% are beginning to explore but have not yet implemented it. This year, we asked for those who are using customer journey mapping how they use it. The result shows over half of the users chose to track customer touchpoints and select target customers. This helps the service rep know what interactions have already happened and what is the status of the issue. Another good sign is that 37% of companies use visualizations for customer journey mapping. This helps to pinpoint a clear picture on all your interactions with the customer to create seamless transactions and services.

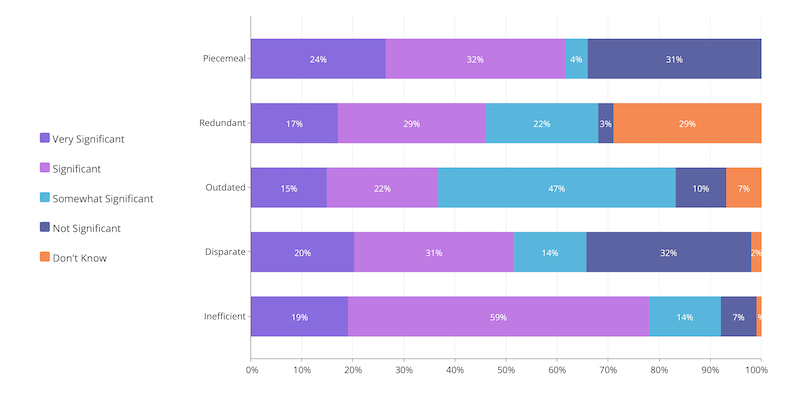

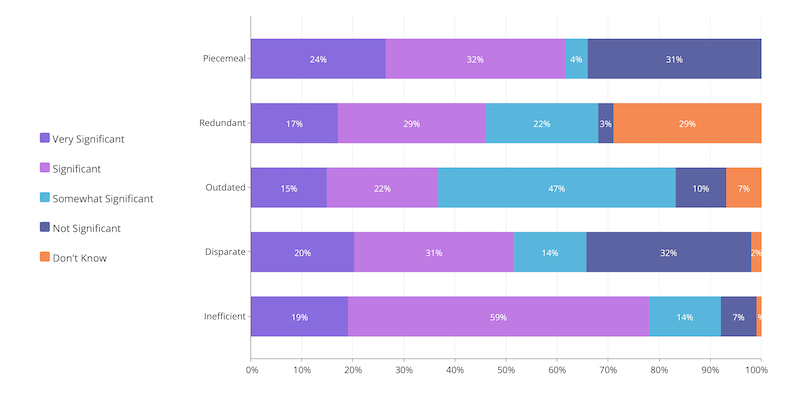

What are the most significant challenges in your customer communications management process/systems?

Survey Findings

Inefficient: For example, similar content from two different departments comes out to be the most significant CCM Challenges with 78% selecting Very Significant and Significant. The second most significant challenge is 56% total for Piecemeal. Departments use different technologies or systems to communicate with customers. On the other hand, a total of 57% of respondents rated Outdated to be somewhat Significant or Not Significant. The second-ranking is Disparate with a total of 46% respondents chose Somewhat Significant or Not Significant. On average about 40% of participants rated these 5 CCM challenges as only Somewhat Significant or Not Significant.

Data Trend

The average percentage of Somewhat Significant or Not Significant is the same as last year at about 40%. Total percentage of Very Significant and Significant for Inefficient raise from 57% to 78% while Outdated use Outdated and Inefficient systems, same as last year, get the most votes for Somewhat Significant or Not Significant.

Analysis

We see companies value Ineffective as a More Significant CCM Challenge this year. This could suggest that there are rising concerns with sending similar content from two different departments to your customer. Meanwhile Outdated is still considered to be the Least Significant by most companies. We again see average of 40% of who rate these 5 challenges as only Somewhat Significant or Not Significant at all. This could be because of two reasons:

• Companies find themselves in a very protected industry sector, or more likely

• These are companies that feel they have already conquered these challenges. This shows a good number of companies are having success with their CCM platform without hitting too many challenges.

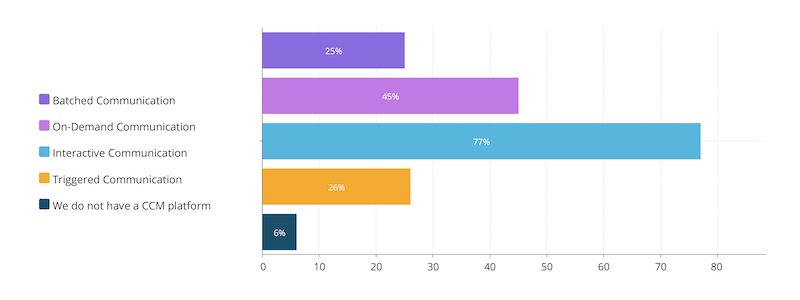

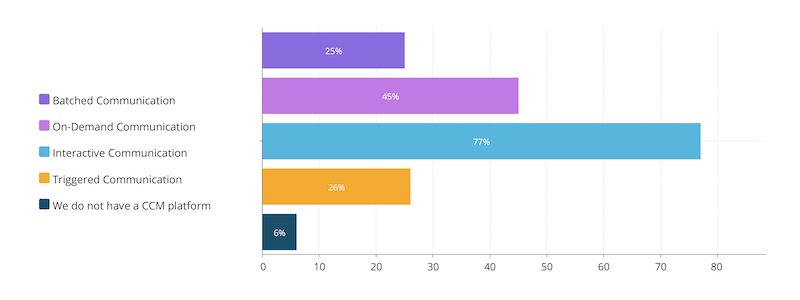

What types of communications do you use your CCM platform for?

Survey Findings

Users can select “all that apply” for this question. They were asked whether they have batch communications or communications that embody on-demand, interactive or automated-triggered delivery methods. 25% of respondents indicated batch communications. 45% have on-demand communications, 77% have interactive communications and 26% have triggered communications.

Data Trend

Last year, we conducted the same questions allowing the participants to only make one choice. We found out that 19% of companies have batched communications as their main method. This year we see 25%. This doesn’t mean an increase in percentage as participants can select “all that apply.”

Analysis

This year we see a quarter of companies having batched communications available as one of the communication methods. We expect to see a decline in the ‘one size fits all’ batch approach and further movement towards individual relationship-rich communications that are on-demand, interactive and/or triggered. These approaches permit an organization to tailor messaging to the individual at the time the customer wants the interaction and via the channel preferred by the customer. This introduces a tremendous increase in the complexity of communications but at the same time offers outstanding opportunities for better and more lasting customer relationships to be built. Organizations that can communicate on the channel desired by a customer, at the time and in the format desired by the customer are going to be the ones where deep relationships are built.

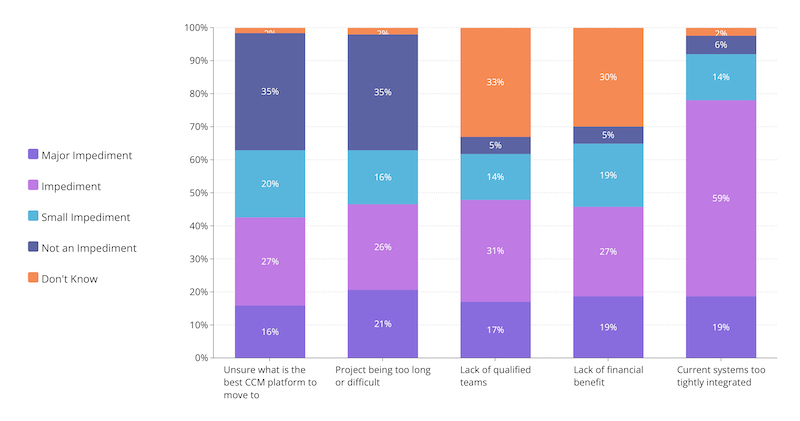

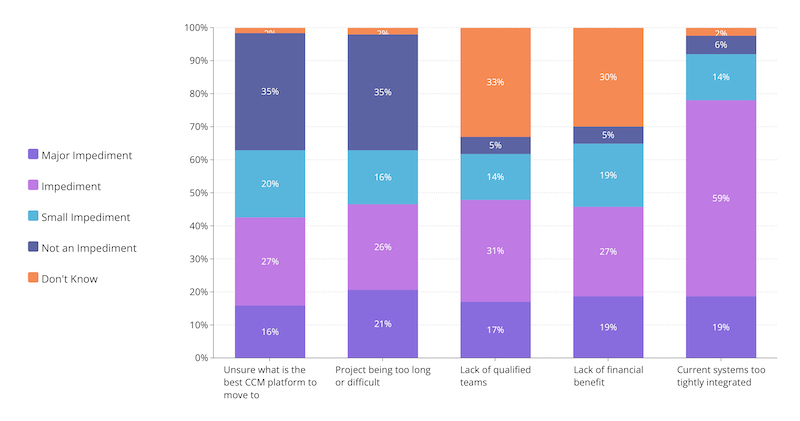

What is preventing moving to an omnichannel CCM platform?

Survey Findings

Users can select “all that apply” for this question. They were asked whether they have batch communications or communications that embody on-demand, interactive or automated-triggered delivery methods. 25% of respondents indicated batch communications. 45% have on-demand communications, 77% have interactive communications and 26% have triggered communications.

Data Trend

Last year, we conducted the same questions allowing the participants to only make one choice. We found out that 19% of companies have batched communications as their main method. This year we see 25%. This doesn’t mean an increase in percentage as participants can select “all that apply.”

Analysis

This year we see a quarter of companies having batched communications available as one of the communication methods. We expect to see a decline in the ‘one size fits all’ batch approach and further movement towards individual relationship-rich communications that are on-demand, interactive and/or triggered. These approaches permit an organization to tailor messaging to the individual at the time the customer wants the interaction and via the channel preferred by the customer. This introduces a tremendous increase in the complexity of communications but at the same time offers outstanding opportunities for better and more lasting customer relationships to be built. Organizations that can communicate on the channel desired by a customer, at the time and in the format desired by the customer are going to be the ones where deep relationships are built.

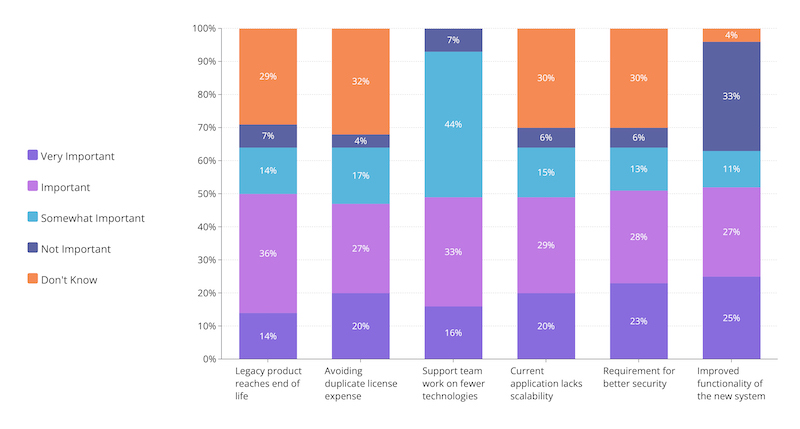

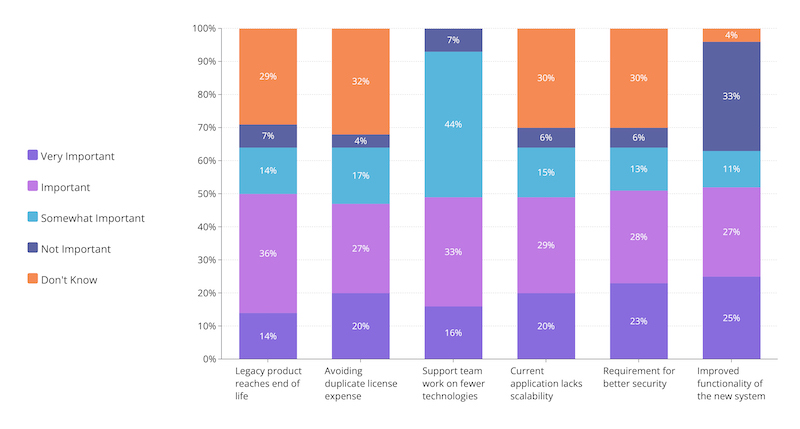

What is the importance of the following factors for migrating off a legacy CCM platform?

Survey Findings

Across all factors, the average rate for Very important and important combined versus the rate for Somewhat important, not important and I don’t know combined is even. Both at 50%.

Analysis

This is a new question for this year’s survey to find out key factors driving companies to consolidate a single omnichannel CCM platform. The result surprisingly shows an even split between the two parties. Half the companies consider the 5 factors to be important and the other either disagree or have not put too much thought into these factors. This is shown as about 30% of the respondents chose, I don’t know for 4 of the 6 questions.

Allen Shapiro is Vice President, CCM & Speech Analytics Practices and Data Protection Officer at Macrosoft. He leads the onshore and off-shore CCM development teams. Additionally, Allen oversees pre-sales activities and is responsible for managing the relationship with the company’s CCM software provider, Quadient.