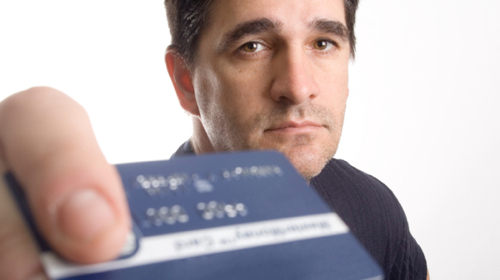

At the end of the day, it’s all about cash flow–how to improve cash flow and lower collection costs by growing electronic payments.

Every department in an organization plays its part. Healthy organizations grow revenue by bringing out new products and services and bringing customers back to buy more.

Let’s focus on collecting the cash!

But none of this matters if you don’t get paid, so let’s spend some time talking about ways to make it easier and less costly to receive payment. Most of you reading this are in support roles, generating invoices, producing letters and documents and doing so with the best customer service for the least cost.

Getting out the invoice on a timely basis is critical. The faster the bill goes out, the quicker the company will be paid. But that is only half the story. Providing your customers with multiple ways to pay can also result in lower collection costs and faster cash flow. No CFO likes to see accounts receivables growing faster than revenue. This is often an indication of something going wrong: Are revenues good, or will they become refunds? Are customers unhappy with the products they received? Is there a billing dispute, which is delaying all or part of the order? Whatever the reason, it’s never a good sign.

To help drive down receivables, companies are working hard to move away from paper payments, and, where possible, from credit card payments. I previously blogged about the migration from paper statements. Now, we should focus on enabling more electronic payments (and next month we can focus on reducing interchange fees).

Starbucks promotes mobile payments with their own app. 10 million customers have downloaded the payment app, processing 5 million transactions a week.

As we continue to move away from cash and checks to credit cards and, more recently, electronic payments, some companies are rolling out new and more cost-effective options.

At one extreme, Starbucks promotes mobile payments with their own app, which provides a great customer experience, while avoiding the high credit card fees. Launched in 2011, today, 10 million customers have downloaded the payment app, processing five million transactions a week, but it’s only good at Starbucks.

Starbucks also has an app they call Square Wallet, which uses a phone and standard credit cards. Google Wallet is designed to consolidate a person’s credit cards and rewards programs in one place. Google is encouraging cell phone manufacturers to include near-field communication radios in their phones, enabling customers to tap his or her phone to a special card reader without swiping or handing over a credit or debit card.

Ok, so you are not Starbucks–tactics for the rest of us.

What can CFOs do to reduce collection costs, payment processing fees and accounts receivables? Well, even if you are not a Starbucks, there is a lot you can do without breaking the bank or taking risk.

There are five readily available areas of opportunity, which can reduce collection costs and improve cash flow. Some require little or no investment and only a few hours training. Others are a bit more complex, but all will provide a rapid ROI and will work seamlessly with your current business structure. They are:

1. Reducing call center and walk-in payments.

- Web payments

- Voice payments (IVR)

2. Reducing the volume of bank generated checks.

3. Turning a mobile device into a credit card machine.

4. Paying from a PDF.

Each of these solutions can be part of a multi-channel payment strategy to simplify the customer payment process. By creating a full suite of payment channels, companies will reduce receivables and reduce the cost of getting paid. Just the words your CFO wants to hear.