The transactional print market is under intense price

pressure. Organizations consider print operations to be a cost center that is

not part of a core business operation. As a result, organizations evaluate

internal operations with a goal of reducing costs or outsourcing the operation.

Service providers, also under price pressure, seek to streamline production

operations and support a broader range of services, such as multi-channel

delivery. While many core applications, such as statements and policies, resist

transition to electronic media, many of the ancillary applications that

provided higher profit margins for print service providers have seen greater

electronic delivery adoption rates. Yet, despite this transition, many large

service providers cannot articulate standard pricing models for electronic

services.

Industry Trends

Madison Advisors recently published the third edition of its

"Service Provider Market Pricing Study," which examines pricing models and trends

for a range of transactional print and electronic delivery services. Typically,

service providers receive electronic files from clients, which they print and

insert into envelopes. Most service providers also submit documents to the post

office or a presort operation for co-mingling with other clients' mail to

reduce postage costs. Service providers may also offer document archiving and

electronic presentment of the printed documents to complete the document

life cycle.

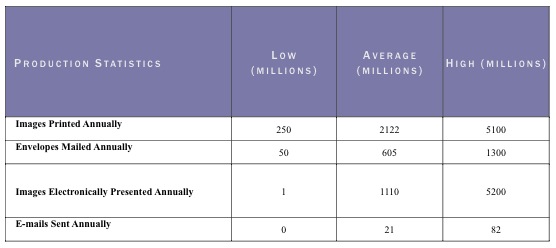

Participants in the study included national and regional service

providers in North America. The following table provides production statistics

for the participating service bureaus.

— Service Provider Annual Production Statistics

During conversations with participants and discussions with

organizations evaluating outsourcing options, Madison Advisors identified

several trends evolving in the print and mail industry.

Multi-Channel Delivery

E-delivery mechanisms, such as email, web presentment and

text messaging, enable organizations to communicate more efficiently. Nearly

all of the participating service providers offer a number of alternatives to

printed communications, due to demand for lower cost communications. For many

print operations, postage paid on an envelope represent half of the overall

cost to produce a document.

In response to customer demand, print service providers have

built robust electronic delivery systems that support high volumes of

electronic presentment, as well as email and text message delivery. Madison

Advisors' research found increasing volumes of email and text messaging,

although they are still considerably smaller than existing postal mail volumes.

On average, emails represent 12% of the communications sent by

service providers and text messages represent three percent.

Customer Portals

Web-based portals allow clients to monitor the current

status of jobs, generate production reports for evaluation of service-level

agreements (SLAs) and control marketing content. In addition, customer portals

provide service providers both an option for enhanced customer service as well

as an opportunity for additional service offerings. The portal software routes

customer communications to the appropriate individual and re-routes inquiries

if the initial recipient is unavailable.

Service providers offer value-added services through

customer portals. For example, several document composition vendors provide

web-based user interfaces that allow content owners, such as marketing

departments, to create and embed messages into documents without disrupting the

document's layout. Service providers embed these interfaces into their customer

portals allowing clients to manage content and marketing messages through the

portal interface.

Job Workflow

Several service providers identified changes to their

workflow processes driven by an opportunity to expand their customer base

down-market to customers with lower print volumes. Over the past few years as

print capacity has remained strong and demand has decreased, service providers

in general have been challenged to maintain growth.

Madison Advisors found that service providers need to

simplify workflow processes to lower overhead and offer production services to

new customers with smaller print volumes. Oftentimes, service providers

required large print volumes to offset the expense of implementing new customer

applications. Simplifying the workflow and reducing the overhead enables the

service provider to remain profitable with smaller print jobs.

Madison Advisors expects more service providers to adopt new

onboarding processes that will allow client files to flow into production

without upfront programming. Madison Advisors' survey found that, on average,

clients provide pre-composed files for almost 40% of the jobs

received by the participating service providers. As more clients implement

their own document composition tools and deliver pre-composed files, the

service providers need to bring these customer jobs into a production factory

without pre-existing factory controls.

Market Pricing

The transactional market consists of large-volume batch

documents, including statements and invoices, which are typically produced on a

daily, weekly or monthly production cycle. Transactional documents contain

personal financial or medical data that requires secure handling and accurate

delivery. Madison Advisors collected data for over 100 services, of

which only a small sample are provided below.

No one service provider offers the lowest prices for every

category. Providers offer a significant range of prices depending on both

volume and vertical markets with emphases on specific verticals. For example,

several providers prefer to bundle the print and insertion pricing into a

single price per sheet for a job.

Continuous duplex printing

represents the most common form of digital print for transactional

applications. For the financial services application (statements), the per

image pricing ranged from $0.0100 to $0.0473. The average price increased from

$0.0169 per image in 2008 to $0.0226 per image in 2011. Madison Advisors

believes that the increased price comes from increased regulations and security

processes associated with financial printing.

A number of service providers have implemented color inkjet

printing systems. Again in financial services, the full-color inkjet print

price per image ranged from $0.0153 to $0.02. The average price per image for

inkjet hovers around $0.06 whereas the same images produced on color laser

systems range from 20% to 90% higher. The price

difference reflects the difference in consumables costs. Since inkjet systems

have evolved to support non-specialty stocks, the materials costs for inkjet

have dropped.

Automated insertion represents the other core production

service. While some service providers bundle print and insertion, most broke

out pricing for our study. For example, automated insertion of a four-page

financial statement ranged from $0.0250 to $0.1259, not including additional

materials, such as marketing inserts or business reply envelopes.

Many service providers offer manual flats insertion for

documents greater than 100 pages and box insertion for very large documents. As

compared to 2008 pricing, the range between the high and low prices for most

categories have become tighter and the average prices dropped by 25%. Even the most highly automated service bureaus provide some manual

processing for very high-page-count items or very small jobs, such as reprint

runs.

Madison Advisors collected data on a number of electronic

delivery services. Most service providers use an implementation and monthly fee

model. The implementation covers the initial system setup and the development

of one or more documents. In some cases, this fee is calculated using a set

number of programming/development hours.

Madison Advisors found that pricing for the initial setup

fee varied widely depending on the size of the client and the volume of print

associated with the proposal. Although most providers do price electronic

presentment services as a separate offering, these services come bundled with a

print/mail proposal. These solutions may also include discounted programming

services and set up of additional documents at a lower rate.

Email represents the most common form of electronic

delivery with prices ranging from $0.03 to $0.08 for processing and delivery of

a PDF document via email. Most providers do not break out the charges into

separate components but rather quote one charge for both. Loading fees

typically go down as monthly volume increases.

Overall, Madison Advisors found that prices for established

services, such and print and insertion, remain relatively stable, while prices

for newer services, such as messaging and multi-channel delivery, have less

variances than in 2008.

RICHARD HUFF is a

principal analyst with Madison Advisors, an advisory firm that specializes in

print and electronic communications. He provides project-based advisory

services designed to assist clients with business strategy and technology

selection decisions. For more information on Madison Advisors, visit www.madisonadvisors.com.