This article appears in the Spring 2017 digital issue of DOCUMENT Strategy. Subscribe.

Image by: apvaper, ©2017 Getty Images

Focusing on customer experience (CX) has become the new normal for customer communication-intensive enterprises, such as banks, insurance providers, utilities, and others. This pivot toward improving CX will require management to look at different key performance indicators (KPIs) to help shape the overall customer journey.

Even though CX-oriented KPIs are increasingly popping up in management dashboards at all levels, progress is slow. Only about one-third of US enterprise respondents surveyed in our 2016 “Customer Engagement Technologies State of the Market” research use CX as a measure for management reporting. Respondents also indicated that the ability to pair CX with business outcomes is a key challenge. Selecting the “right” CX KPI is crucial and should be carefully considered before acting on the strategic initiatives it implies.

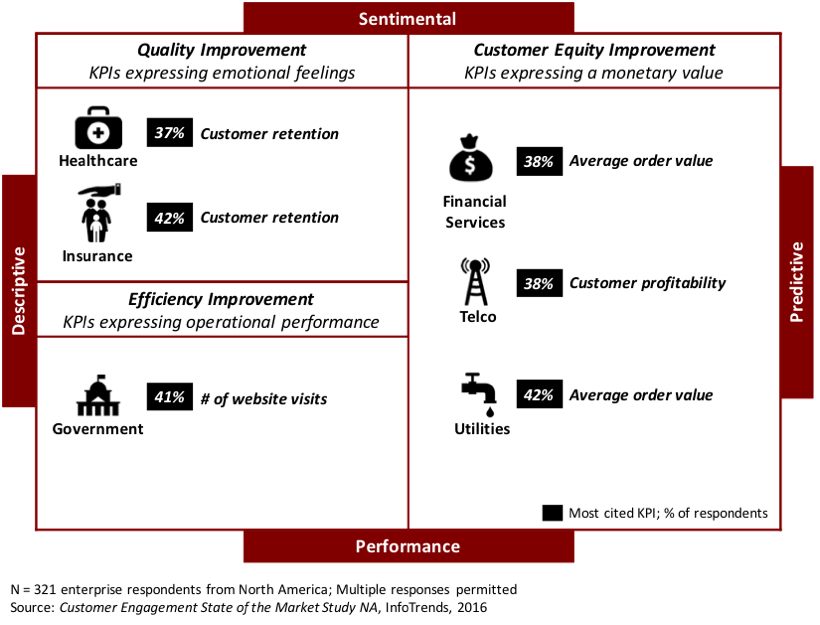

As part of our annual research, InfoTrends examines the various types of KPIs used to track CX. In the Summer 2015 issue of DOCUMENT Strategy, we defined the three main categories as follows:

- KPIs for improving the quality of customer experience are typically expressed using sentimental measures based on past experiences.

- KPIs for improving the efficiency of customer experiences are most often expressed using operational measures based on past event.

- KPIs used for improving customer equity can be either sentimental or operational measures, tend to be forward-looking, and are usually translated into a monetary value.

Filtering our research through this framework allows us to analyze which CX KPI is preferred in various industries, including customer retention, number of website visits, customer profitability, and average order value.

Customer Retention KPI

Customer retention expresses the ability of a business to retain its customers over time. This is a relevant KPI for any organization, since even a relatively small improvement in retention can have a significant impact on the bottom line. Businesses depending on a large customer base will especially benefit from this KPI. Our research indicates that insurance and healthcare companies consider this KPI to be most important for managing CX. Customer retention requires businesses to maintain quality relationships with the customer and appropriately address customer complaints. Customer communications in these areas strongly influence customer loyalty.

David Stabel is the Director of Customer Communications Advisory Services at InfoTrends, a division of Keypoint Intelligence. Don’t miss his session on self-service portals on Tuesday, May 2 at the DOCUMENT Strategy Forum in Chicago.

Number of Website Visits KPI

Recording the number of individuals who viewed a website over a given period doesn’t necessarily reveal much about CX; however, it does measure a message’s reach. Governments in the midst of their digitization journey highly value this KPI. For them, reaching a broad number of citizens is crucial (if not mandatory). Customer communications technology can help with managing information updates (e.g., changes in legislation) and present it in an appealing way. Both are important ingredients for a digital front desk.Customer Profitability KPI

Customer profitability is the difference between revenues from a customer minus the cost associated with keeping that customer over a specified period of time. Businesses that play in price-sensitive markets, such as telecommunications, should carefully watch this KPI, since a satisfied customer is not necessarily a profitable one. Customer communications influence both sides of the profitability equation. Through targeted and personalized promotional messaging, revenues per customer can be increased. On the other hand, customer communications technology that allows businesses to automate communication flows and increase customer loyalty through more relevant and contextual means—using preferred communication channel(s)—will reduce the cost per customer.Average Order Value KPI

By definition, the average order size expresses the average value of an order. Beyond defining the average value of a given order, this KPI also measures the effectiveness of cross-selling and upselling initiatives. Businesses in financial services and utilities satisfy a basic need. For example, banks typically manage an account, fund, or portfolio for their customer, while utilities offer common services like energy or water. These businesses benefit from growing their share of the customer’s wallet beyond these basic needs. Cross-selling and upselling, as well as building customer loyalty, are critical strategies for these companies. Therefore, it is no surprise that survey respondents working in these industries rated this KPI as their most important.The Bottom Line

Clearly, there is no single “right” CX KPI that businesses can employ to surmount all their customer experience challenges. Instead, a thorough understanding of the business model and target markets are prerequisites for selecting which KPI best supports CX improvement within your organization.David Stabel is the Director of Customer Communications Advisory Services at InfoTrends, a division of Keypoint Intelligence. Don’t miss his session on self-service portals on Tuesday, May 2 at the DOCUMENT Strategy Forum in Chicago.