Book printing has been a fertile market for digital printing equipment: In terms of output, book printing is one of the largest print markets, and digital print volume continues to grow year over year. In examining digital printing equipment usage patterns by book printers, we see two markedly distinct trends: a strong uptake in ultra-short run production and steady penetration into longer runs (2,000 books and higher). Leading book printers surveyed by INTERQUEST agree on the macro trends in the overall book market—the growth of eBooks, ever-shorter print runs and continued adoption of digital printing to manufacture books. A closer look at these market trends helps explain the seemingly contradictory usage patterns we see with digital book printing equipment.

|

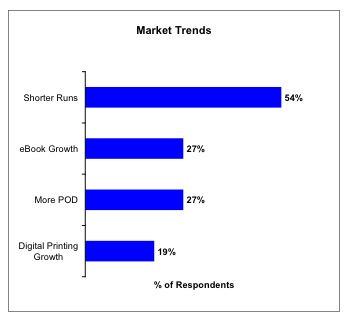

Figure 1. Leading Trends in the Book Market Cited by Book Printers (Source: INTERQUEST). |

eBooks sales have doubtlessly suppressed print sales. Nielsen BookScan finds that unit sales of printed books in the US dropped by 9.3% in 2012 over the prior year. As in recent years, the biggest drop-off was found in mass market paperbacks. The growth in eBooks and the decline in printed books has introduced a great deal of uncertainty to an already uncertain market. Publishers and retailers alike are more conservative in ordering printed books. Although best sellers continue to exert tremendous sway to the numbers (Publisher’s Lunch, for instance, estimates that the Hunger Games series could have accounted for as much as 9.5% of all children’s book sales for the year), the downward trend in ordering patterns has resulted in an across-the-board decrease in print runs.

Declining print runs and tighter control of inventory has driven more books to short-run digital printing equipment. Digital systems are now routinely used to top off inventory levels at warehouses and distribution centers, saving publishers millions of dollars in inventory write-down. This is one major reason printers and publishers we survey say that the adoption of digital printing is a key trend in the supply chain.

In our most recent survey of book printers, we saw a remarkable increase in the use of print-on-demand, typically for books of 20 units and under. This highly specialized realm, which was pioneered by Ingram’s Lightning Source, is now increasingly offered by other book printers. Self-publishing accounts for some of this growth, but we find the increase in POD among a broad range of book printers, including those that do not serve the self-publishing market. It is more likely that an increasing number of publishers are turning to digital print to tap so-called long tail sales from their backlists. In many instances, these publishers prefer working with suppliers that can meet all of their printing needs, including long-run conventional printing, short-run digital and print-to-order manufacturing.

|

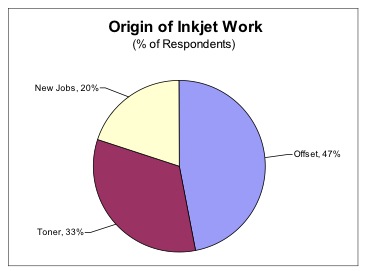

(Source: INTERQUEST). |

At the other end of the spectrum, we find digital printing increasingly used for run lengths as high as 2,000 to 3,000 books. The process breakeven between digital printing and conventional processes is an ever-changing target, but as publishers increasingly take a more holistic view of cost and factor in inventory and other expenses, the cross over moves higher. In addition, inkjet printing has dramatically impacted the equation and is steadily edging its way into longer print runs.

The adoption of inkjet by book printers has been remarkable. In our most recent study of the book market, we find that nearly half of the book printers surveyed are using high-speed inkjet presses to produce books—nearly double the percentage reported two years earlier. Volume growth on inkjet equipment is even more impressive; our survey finds that inkjet now accounts for nearly one-third of digital impressions devoted to book printing. Nearly half of the work produced on inkjet presses has been migrated from offset presses.

The drive of digital printing towards both ends of the market is clearly a result not only of changing dynamics in the book market but of improvements in the cost and performance of digital printing equipment. Developments in the areas of finishing and substrates are also critical considerations. We expect these trends to continue to play out over the next few years. While the volume of printed books will continue to decline, digital systems will gain an increasing share of printed books. Digital book impressions will grow at double-digit rates in most sectors of the market and will account for more than one-fifth of all impressions by 2017.

Tweet

DAVID DAVIS is a director for INTERQUEST, a market

and technology research and consulting firm in the field of digital printing

and publishing. He has more than 25 years of experience in the printing

industry and is the author of numerous industry reports, publications and

educational programs on a variety of industry topics. Contact Mr. Davis at 434-979-9945

or visit www.inter-quest.com.

Tweet